How to Transfer Money with Wise: A Beginners Guide 2025

Wise (formerly TransferWise) is an online specialist in international payments and multi-currency account services for individuals and businesses. Since launching in the UK in 2011, Wise has expanded internationally to serve a broad range of countries with payments that are fast, cheap and easy to set up.

Wise has invested in innovative ways to make international money transfers easier, resulting in a cost-effective, transparent and convenient solution for sending and receiving cross currency transfers.

This guide covers all there is to know about sending money overseas with Wise, including how the process works, a step by step to get started and a look at Wise fees and exchange rates.

How does Wise work

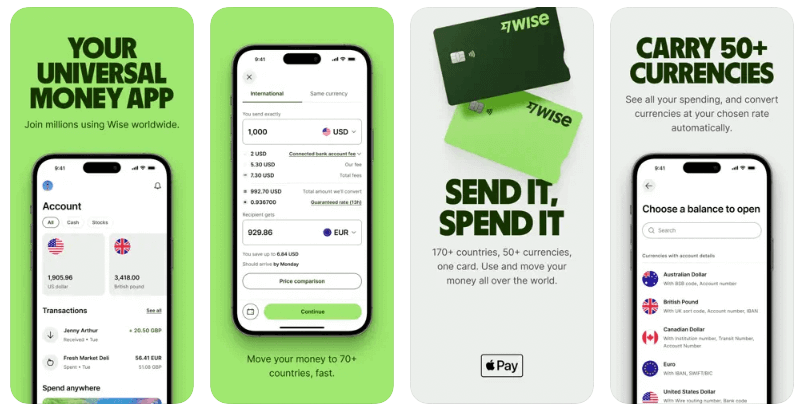

With Wise you can send a payment to a bank account in 70+ countries, for fast or even instant deposit in the currency needed by your recipient. All Wise transfers are set up online or in the Wise app, and you can choose to pay in AUD using a range of options including local bank transfer, card, POLi or PayID. Wise will then convert your funds to the required currency and deposit them conveniently into the recipient’s bank account.

Wise offers low, transparent fees compared to many other financial services – and can deliver payments faster too. That’s largely thanks to the Wise payment network – an innovative new way to process international transfers with no middleman and lower costs compared to SWIFT, the network preferred by banks.

You’ll send your money to Wise’s account in Australia and then once it arrives, Wise pays out to your recipient from their account in the destination country. This network of bank accounts all over the world means that Wise transfers don’t really have to cross borders – cutting costs and making the entire process faster.

Here are some key points about sending a Wise international payment:

- All Wise currency conversion uses the mid-market exchange rate with no extra fee added

- Wise has low transfer fees which are split out for transparency and which start from just 0.43%

- Wise payments are fast – 50% are instant and 90% arrive in a day

- It’s easy to set up a Wise payment online or in the Wise app, no need to visit a branch

Read our Wise review for following detailed information.

How to transfer money overseas with Wise (formerly TransferWise)

Step 1: Go to Wise

Go to the Wise website or download the Wise app for free on iOS and Android.

Step 2: Sign up

Enter your email address, Facebook, Apple or Google ID and create a secure password, which you will use to access the account in the future.

Step 4: Verify your account

You’ll need to follow prompts to provide your full name, date of birth, contact number and residential address. You’ll also be prompted to upload an image of your ID document and a proof of address – all you need is a photo captured with your phone.

Step 5: Create your transfer

Once you have a verified Wise account you can set up your first payment. Enter the amount you want to send or the amount and currency you want the recipient to get. You’ll see the different ways you can choose to pay, the exchange rate and the costs of sending your transfer. You’ll also see a delivery estimate.

Step 6: Recipient details

Once you’ve checked everything over, fill in the details of the account you’re sending the money to. This can differ depending on where you’re sending it, but you’re guided throughout by on screen prompts.

Step 7: Pay for the transfer

Once you’ve filled out all the required information you’ll be able to pay for your transfer using your chosen payment method. Again, you’ll be taken through step by step using on screen prompts.

Step 8: Confirmation

The final step will be a confirmation of your order, it will include the rate you received, the amount you’re sending and the total your recipient will receive once the transfer has been completed.

How to transfer money with Wise – step by step video

Do I need a bank account to use Wise?

If you’re sending a Wise payment, the cheapest option is usually to pay using your bank account or debit card. However if you don’t have a bank account you can also use a credit card.

If you’re receiving a Wise payment you can have your funds deposited to your normal bank account – or if you don’t have a bank account in the currency you’re receiving you could open a Wise account which lets you receive up to 9 currencies conveniently.

Can I transfer money to Wise from my bank account?

Yes. If you’re sending a Wise payment you can choose to pay with a local bank transfer if you’d like. That’s often one of the cheapest options and can be convenient using your bank’s online or mobile banking system.

How can I pay for my transfer with Wise?

If you want to pay for your Wise international transfer in AUD you can pick from the following options:

- Bank transfer

- Credit or debit card

- POLi

- PayID

- Send from an existing Wise balance

How to use the Wise app

Download the Wise app and you can send Wise transfers easily with just your phone. The basic steps to set up a Wise account and start sending money, are much the same as those outlined above. Here’s a quick reminder of how to use Wise, focusing on using the Wise app specifically:

- Download the Wise app for free

- Register an account by entering your personal and contact information

- Get verified by uploading a photo of your ID documents

- Model the payment you want to make to get a fee and rate quote

- Choose how you want to pay

- Check everything over and confirm – you’ll be prompted to pay using your chosen payment method

How much does Wise charge to transfer money?

Wise uses the mid-market exchange rate to convert your money to the currency you need to send your payment. There are then a couple of costs which can vary based on the destination country and currency, and how you choose to pay for the transfer. You’re shown these fees clearly when you set up your payment – and before you tap confirm – so you can check and compare to see if Wise suits your needs.

Wise uses its own payment network to process transactions, and doesn’t have a physical branch operation, which keeps costs low compared to brick and mortar banks using SWIFT. Wise then passes this saving to customers in the form of lower fees and better rates. That can mean that using a service like Wise comes with a lower overall cost than a bank.

Wise exchange rate

Whenever you exchange money with Wise you get the mid-market exchange rate. That’s the one you’ll find with a currency conversion tool and also the one banks get when they buy and sell currencies on wholesale markets. However, banks usually add a markup – an extra percentage fee – to the mid-market rate when they calculate the rates offered to retail customers. This isn’t easy to spot and can mean that the overall costs are higher than you think when you send a payment with a bank.

Wise uses the mid-market rate because transparency is important. You see the rate and the costs split out clearly so you can identify the amount you’re paying for your transfer without needing to pick apart the maths.

How long does it take to transfer money with Wise internationally?

Because Wise uses its own payment network rather than the SWIFT network, transfers can be far faster than with your bank. While the exact time it takes to transfer money with Wise internationally does vary based on factors like the destination country and the payment value, overall, 50% of Wise international transfers are instant or arrive in seconds, and 90% are there in 24 hours.

You’ll see a delivery estimate before you confirm your Wise international transfer which will let you know when your money may be deposited and ready to use. Once you’ve confirmed your payment you can also track it easily in the Wise app.

Limits to transfer money with Wise

If you’re sending money from Australia there may be some transfer limits based on how you want to pay, and some limits also apply based on the destination currency.

From AUD you can usually send up to 1.8 million AUD by bank transfer or POLi – although your own bank may impose limits which are lower than this. You can also send up to 18,000 AUD if you pay by card, or up to 50,000 AUD by PayID.

The limits which apply based on the currency you’re sending to vary but are generally set high to allow customers to transact freely. Limits are usually in the region of 1 million GBP or the currency equivalent.

How to receive money with Wise

You can receive money with Wise in 2 ways:

- Deposit to your bank account

- Open a Wise account and receive payment there in 9 supported currencies

If you want your money deposited to your normal bank account all you have to do is give the sender your bank details (including your name, account number and BSB). The payment will be deposited to your account once it’s been processed with no need for further action on your part.

As an alternative you can also open a Wise account and have your money deposited there using the local bank account details that come with Wise. When you set up your Wise account you can get local account details in 9 major currencies including AUD, NZD, USD, GBP, EUR and more. You can then simply give these details to the person sending you a payment and the funds will be deposited right to your Wise account for convenience.

Here’s a quick step by step guide to opening a Wise account and receiving a payment there:

- Download the Wise app or sign up on the Wise desktop site

- Register an account by entering your personal and contact information

- Get verified by uploading a photo of your documents

- Once your account is verified, tap the + symbol in the app to open a balance in the currency you want to receive

- Tap the currency balance and then select See local account details

- You’ll be shown the account information you need – share this with the sender

- Your money will be deposited to Wise directly

How much does it cost to receive money with Wise

If you’re receiving a payment with Wise to your normal bank account there’s no Wise fee to pay. Bear in mind you may find your own bank charges a fee for incoming payments.

If you’re receiving money to Wise into your own Wise account with your local bank details, it’s free to receive in most cases. The exception is if you’re getting paid by wire in USD – a 4.14 USD charge applies in this situation, but you can get USD for free if the sender uses an ACH payment instead.

Conclusion

Sending money internationally with Wise is easy and can all be done online or in the Wise app. You’ll be able to pay for your transfer in AUD and have it deposited into your recipient’s account in any of the 70+ supported countries.

Because Wise has developed its own network of bank accounts globally, it can process international payments faster and with lower fees compared to many banks. Check out how Wise compares on cost, transparency, speed and ease of use, against a few other options to get the best one for your specific needs.

FAQs – How to Transfer Money with Wise

How do I transfer money from Wise to another account?

If you have a Wise balance you can send money from it, to another account in someone else’s name, or withdraw to your own bank account. If you’re sending a payment to someone from your Wise balance you’ll set up your payment as usual and just choose Wise balance as your preferred payment option when prompted.

How much can I transfer to a Wise account?

The amount you can receive in a Wise account is often unlimited but it’s helpful to know that there are limits on holding a balance in some countries or in certain currencies. Get all the details on the Wise desktop site, or reach out to the service team for further assistance if you run into issues.

How to use Wise for international transfers

To send a Wise international transfer you’ll just need to enter the amount and currency you want to send, or what you need the recipient to get in the end, on the Wise desktop site or app. Follow the prompts to pay, and your money will get moving right away.