Using your ANZ Card Overseas: The Rundown 2025

ANZ offers several different card options which can be handy for paying and making cash withdrawals. You might have the ANZ Visa, the ANZ Access Visa, an ANZ Plus card, or an ANZ credit card. So – if you’re an ANZ customer heading off from Australia for an overseas tip, can you use your card while you’re away?

This guide walks through whether you can use your ANZ card overseas, what it might cost you, and what steps you need to take to transact smoothly abroad. We’ll also touch on a couple of alternative cards which can make a handy backup, like Wise or Revolut, which may also help you save money on your foreign currency spending.

Can I use the ANZ card overseas?

Yes. You can use your ANZ card overseas.

Whether you’re already an ANZ Australia customer with a credit or debit card – or you’re thinking of signing up – the good news is that most popular ANZ cards can be used conveniently overseas. However, there may be fees to pay, which can be higher than the fees you pay for using your card at home.

It’s important to read your own card’s terms and conditions carefully, but as a headline, most ANZ cards have a 3% foreign transaction fee you’ll pay every time you use them to spend in a foreign currency. You may also pay a 5 AUD overseas ATM fee if you use a debit card – and cash advance fees of up to 20 AUD if you’re using a credit card in an ATM abroad.

How to get an ANZ card in Australia

You can order an ANZ card if you are 12 years or older, and an Australian resident with an Australian residential and mailing address. If you have an account with ANZ already, simply log into your online or mobile banking banking to order your card. If you do not have an ANZ account already you can apply online. Here’s what to do;

- Open the ANZ website or app

- Select the account you’d lille to open

- Tap Open now, and follow the prompts to add your personal and contact information

- Upload images of your ID and address documents for verification

- Confirm the debit card you would like, and complete your order

How do you use ANZ when travelling abroad?

ANZ cards are mainly issued on the Visa network, which is widely accepted around the world. This should mean you can use your card in 100 million+ merchants globally, just like you would at home. Tap to make contactless payments, use your card with a wallet like Apple Pay, and make ATM withdrawals.

It’s worth remembering that ANZ is likely to add extra fees when you use your card overseas – usually a 3% foreign transaction fee applies for all payments and withdrawals. ATM fees also apply.

Do I need to activate my ANZ card for overseas use?

You should not need to activate your ANZ card to use it abroad. However, you should consider making ANZ aware of your travel plans, which you can do in the ANZ app. This means that ANZ will not limit or block your card if they have fraud concerns due to unexpected international use.

No matter where you go, it is worth making sure your contact information is up to date with ANZ so they can call you if there are any issues or any suspicious transactions on your account.

Benefits of choosing an ANZ card abroad

Selecting the right payment method when travelling can help you save money – and cut down on unnecessary stress, as well. Using a card is convenient and safe because you won’t need to carry lots of cash with you – just make withdrawals from ATMs overseas as and when you need to. Here are a few benefits of the ANZ card for international use:

- ANZ offers various debit and credit cards, all of which can be used overseas conveniently

- ANZ cards are usually issued on the Visa network which is very widely accepted

- You can make withdrawals from ATMs with any ANZ credit or debit card, which avoids carrying lots of cash with you

- You can inform ANZ of your travel plans in advance to ensure your card is not blocked when you travel

- Manage your card and view your transactions from your phone, wherever in the world you are

An alternative to ANZ:

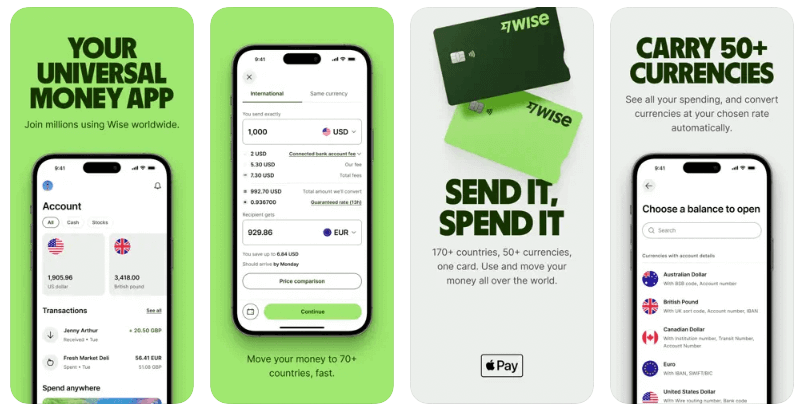

Wise: Wise accounts support 40+ currencies for holding and exchange, and you can order a Wise card for convenient spending and withdrawals in 150+ countries. It’s free to spend a currency you hold in your account. All currency exchange uses the mid-market exchange rate with low fees from 0.33%, and you’ll get some free ATM withdrawals every month before paying any fee, too.

Wise: Wise accounts support 40+ currencies for holding and exchange, and you can order a Wise card for convenient spending and withdrawals in 150+ countries. It’s free to spend a currency you hold in your account. All currency exchange uses the mid-market exchange rate with low fees from 0.33%, and you’ll get some free ATM withdrawals every month before paying any fee, too.

Revolut: Revolut offers several different account types, all of which come with linked cards which you can use for spendingand withdrawals. Accounts support 25+ currencies, with no fee to spend a currency you hold. All accounts have some weekday currency exchange every month which uses the Revolut exchange rate with no extra fees, to plan limits. Once you’ve exhausted your plan’s exchange limit, fair exchange fees apply.

Revolut: Revolut offers several different account types, all of which come with linked cards which you can use for spendingand withdrawals. Accounts support 25+ currencies, with no fee to spend a currency you hold. All accounts have some weekday currency exchange every month which uses the Revolut exchange rate with no extra fees, to plan limits. Once you’ve exhausted your plan’s exchange limit, fair exchange fees apply.

Can I order an ANZ card abroad?

To order an ANZ Australia debit or credit card you must be an Australian resident. You’ll be asked to give and prove your residential address when you apply.

Can I keep my ANZ card if I move abroad?

ANZ Australia primarily serves Australian residents. This may mean that if you move abroad you’ll need to close down your account and your card will be deactivated.

If this is the case, you can apply for a new card from a provider like Wise which operates in many countries and regions globally. Open a Wise account using your new address outside of Australia, to hold 40+ currencies, including AUD, conveniently. You’ll also be able to order your card to use in Australia and around the world for low cost spending and withdrawals.

Read also:

Will my ATM card work overseas?

Yes. Your ANZ card will work in most global Visa ATMs. Look out for the Visa logo on the ATM before you start.

Bear in mind that ATMm availability varies depending on where in the world you are. In many countries, ATMs are few and far between in more rural areas or small towns, so do check for your destination if you’re travelling. Fees are likely to apply when you use your ANZ card at an ATM abroad. This can be a 5 AUD flat fee, or a percentage cash advance fee if you use a credit card. 3% foreign transaction fees are also likely to apply.

Cash usage varies depending on where you are in the world. However, even in countries where cards are widely accepted, having some foreign currency cash in your pocket can be reassuring.

How can I avoid overseas ATM fees

Most ANZ cards have a fee for overseas ATM use of 5 AUD for a debit card, and up to 20 AUD for a credit card. Choose a card from a provider like Wise or Revolut which can offer some no fee ATM withdrawals every month, to cut your overall costs. By choosing a multi-currency account like Wise or Revolut you might also limit the costs of currency conversion by avoiding foreign transaction fees.

Tips for saving travel budget abroad

Make your money go further on your trip with these handy hints:

- Avoid the fees associated with dynamic currency conversion (DCC) – when using your card, always pay in the local currency wherever you are, to dodge bad rates and high fees caused by DCC

- Keep several payment methods on you at all times – have a little cash, a multi-currency travel card and your ANZ card, for example, so you can pick the right payment method for the specific transaction

- Don’t use the ATM too frequently – if you have a safe place to store cash you may want to limit trips to the ATM if your provider charges a flat fee per transaction

- Get a multi-currency account – providers like Wise and Revolut let you convert AUD to the currency you need in advance or at the point of payment, with great exchange rates and low fees

FAQ – Using ANZ card overseas

I’m going abroad soon, will ANZ be ok for the trip?

ANZ debit and credit cards can be used overseas. Inform ANZ of your plans in advance to avoid your card being limited or blocked, and bear in mind there will be extra fees including a 3% foreign transaction fee added to all purchases.

Can I use ANZ after moving abroad?

You may be asked to close your account with ANZ when you move. In this case, consider a multi-currency account from providers like Wise and Revolut to continue transacting in AUD as well as many other currencies, with accounts available in many countries and regions.

Is ANZ card good for international travel?

You can use ANZ debit and credit cards wherever you see the Visa logo overseas, but you’ll pay extra fees when you do. A 3% foreign transaction fee is added to all purchases, and overseas ATM use can also be more expensive than getting cash at home.

How long does it take to order a travel money card in Australia?

Travel money card delivery times can vary, but as an example, you would receive a Wise card 7 to 14 days after you order it. Plan in advance to open an account with a specialist like Wise, to cut the costs of spending while you’re away from home.