5 Best Banks for International Money Transfers 2025

If you need to send an international payment you may be considering using your normal bank as a secure and convenient option. Sending an international wire with your bank shouldn’t be too much of a headache – but it can be quite expensive, and because third party fees may creep in, your recipient might get less than you were intending in the end.

This guide walks through the pros and cons, features and fees of sending money overseas with 6 major Australian banks.

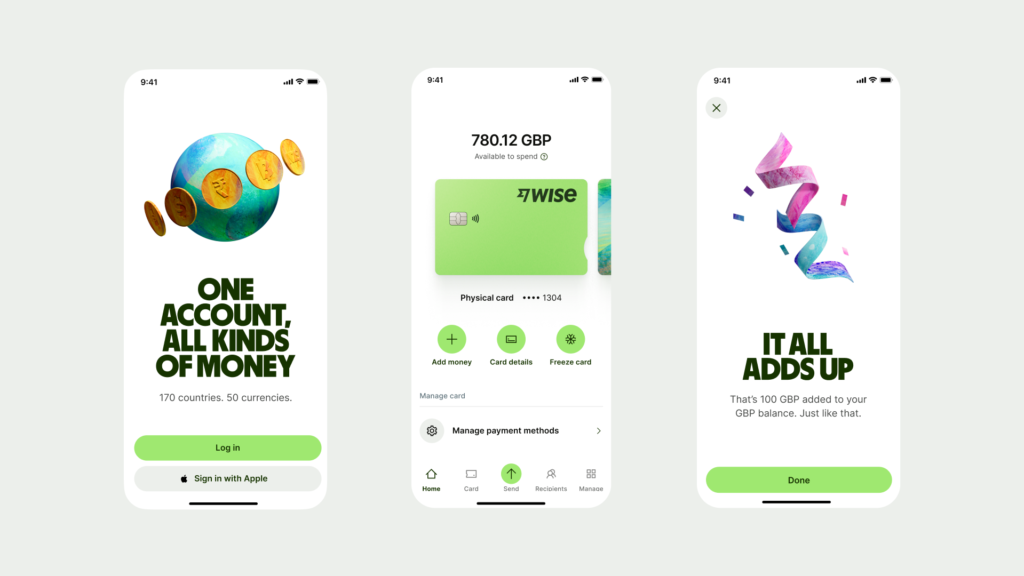

Banks aren’t your only option for moving money overseas – an online specialist service like Wise or OFX may be able to offer a better exchange rate, a lower overall cost, and a faster delivery. We’ll touch on a few alternatives to regular banks later, to help you compare and choose.

Which bank is best for international transfers?

The best bank for your international transfer may not be a bank at all. Specialist services can often provide lower fees and a better exchange rate compared to your bank. We’ll look at a few specialist alternatives in just a moment, but first let’s see how our 6 big banks measure up against OFX and Wise on fees and exchange rates.

| Provider | International wire fee | Exchange rate |

|---|---|---|

| Wise | Low fee which varies by destination | Mid-market exchange rate |

| OFX | No fee | Exchange rate includes a small markup |

| ANZ | 9 AUD transfer fee + any relevant intermediary fees

Fee waived for high value payments |

Exchange rate includes a markup |

| NAB | Transfer fee waived – any relevant intermediary fees will still apply | Exchange rate includes a markup |

| St George Bank | 10 AUD transfer fee + any relevant intermediary fees | Exchange rate includes a markup |

| Bendigo Bank | 30 AUD transfer fee + any relevant intermediary fees | Exchange rate includes a markup |

| Suncorp | Transfer fee is waived – any relevant intermediary fees still apply | Exchange rate includes a markup |

| HSBC | 8 AUD transfer fee + any relevant intermediary fees | Exchange rate includes a markup |

Alternatives to international wire transfers with banks

Sending your international payment with a bank is secure and familiar. But it may also be expensive and slow. Specialist services are safe to use – they’re usually regulated in the same way your bank is – and can often offer a lower overall cost. Here are a few to consider:

- Wise: Send to 80+ countries, with the mid-market exchange rate and low, transparent fees. 50%+ of payments arrive instantly

- OFX: Make payments in 50+ currencies online, in app and by phone. There’s no transfer fee and the rates offered can beat the banks

- TorFX: Send money online or over the phone, and get award winning customer service if you want to talk through your options

- WorldRemit: Online and in app payments to a range of countries around the world, with a good range of pay out methods

- Remitly: Send digitally on popular remittance routes, and pick a faster Express fee or a cheaper Economy service

At the end of the day there’s no single best way to send your international payment. It depends on the transfer value and currency, so comparing a few different options is your best bet.

Online providers like these we’ve detailed above can often offer lower overall costs and give you an instant quote online so you can easily see which works best for you.

Looking for the best Australian bank for an international wire transfer?

Let’s start with an overview of the fees that apply to international wires from 6 big banks:

- ANZ – 9 AUD transfer fee + exchange rate markup + any relevant intermediary fees

- NAB – Transfer fee waived – exchange rate markup + any relevant intermediary fees will still apply

- St George Bank – 10 AUD transfer fee + exchange rate markup + any relevant intermediary fees

- Bendigo Bank – 30 AUD transfer fee + exchange rate markup + any relevant intermediary fees

- Suncorp – Transfer fee is waived – exchange rate markup + any relevant intermediary fees still apply

- HSBC – 8 AUD transfer fee + exchange rate markup + any relevant intermediary fees

*These outbound wire transfer fees do not take into account the exchange rates charged by the banks which almost always include additional costs and charges.

As you can see, the upfront transfer fees from major Australian banks do vary widely. Exchange rate markups and third party costs can also apply even where transfer fees are waived, which push up the price further.

You may find alternative services such as Wise or OFX for international transfers with more transparent fees and – often – a better exchange rate. More on that later.

Things to consider when choosing an international transfer provider

Not sure how to arrange your international wire? Here are some factors to consider when you’re deciding:

- Costs – before you get started make sure you’ve thoroughly read the payment fee schedule. The transfer fee you pay can vary widely depending on how you structure the payment.

- Speed – international wires commonly take 3 to 5 days to arrive in the destination account when sent with a traditional bank. Check the delivery times when you arrange your payment.

- Exchange rates – compare the exchange rate your bank offers against the mid-market rate you’ll find on Google. It’s common for banks to add extra fees here, so doing a bit of homework and looking at a few alternatives can save you money.

- Convenience – check out the options for sending your payment – while many banks let you set things up online or in an app, some still require you to head into a branch in person.

Type of fees for international wire transfer with banks

Australian banks will charge you in several different ways for an international wire transfer:

Bank sending fee: The bank will charge a fixed fee for each international money transfer that you make. This fee can vary depending on the type of account you have, how you’re making the transfer and the currency you send.

Exchange rate markup fee: An Australian bank typically offers a worse exchange rate than the base exchange rate, often between two and four percent worse than you might get elsewhere. This is a hidden fee as the bank pockets the difference.

Correspondent bank fee: Third party charges which can be called agent fees, intermediary fees, SWIFT fees or correspondent bank fees. You may not be able to see the exact cost of these charges in advance of confirming your transfer.

Receiving bank fee: Finally, the beneficiary’s bank will probably charge a fee for them to receive the money into their account.

All of these fees do add up and can mean the beneficiary ends up receiving quite a bit less than you sent them. When we’re comparing fees below, we’ve only included the bank sending fees, as most Australian banks don’t share the exchange rates they use and the correspondent and receiving bank fees vary so much.

International wire transfer fees for australian banks

Here’s an overview of the typical costs for sending an international wire with 6 large Australian banks. The exact price you pay may vary based on how you set up your transfer – in branch payments are often more expensive than online transfers for example, and payments made in AUD overseas can also attract further fees.

| Provider | International wire fee |

|---|---|

| ANZ | 9 AUD transfer fee + exchange rate markup + any relevant intermediary fees |

| NAB | Transfer fee waived – exchange rate markup + any relevant intermediary fees will still apply |

| St George Bank | 10 AUD transfer fee + exchange rate markup + any relevant intermediary fees |

| Bendigo Bank | 30 AUD transfer fee + exchange rate markup + any relevant intermediary fees |

| Suncorp | Transfer fee is waived – exchange rate markup + any relevant intermediary fees still apply |

| HSBC | 8 AUD transfer fee + exchange rate markup + any relevant intermediary fees |

How to avoid international transfer fees with Banks

With charges added into the exchange rates and hard to spot intermediary bank fees, international wire transfers with traditional banks can be costly.

Here are some tips on how you could keep your costs down:

- Sending money through your bank’s online or mobile banking service is almost always cheaper than visiting a branch

- If you need to send someone a lot of money, using one larger payment can be cheaper than sending several small transfers, thanks to the fixed transfer fees that apply

- If you can, use a specialist international payment provider. You’ll be able to make your payment online or in an app for convenience, and can often find lower costs and a better exchange rate compared to a regular bank

- Compare some different transfer services to make sure you get the best value for your particular payment

Best Bank for International Wire Transfers

We’ve looked at 6 of the most popular banks in Australia, to see how they measure up on international wire transfers. We’ll look at the fees, rates, limits, pros and cons of each of the following banks in Australia:

- ANZ

- NAB

- St George Bank

- Bendigo Bank

- Suncorp

- HSBC

ANZ international transfers

ANZ customers can send payments online with no fee if the value of the transfer is above 10,000 AUD. However, it’s worth remembering that exchange rate markups will still apply, and any intermediary fees – for example, the charges the recipient’s own bank applies – will also be payable. That can mean your recipient gets less than you were expecting.

| Pros | Cons |

|---|---|

|

|

ANZ transfer fees

Send international payment under 10,000 AUD in a foreign currency, online or by phone: 9 AUD transfer fee + exchange rate markup + any relevant intermediary fees

Transfer fee waived for transfers over 10,000 AUD in value – exchange rate markup + any relevant intermediary fees will still apply

Send AUD international payment: 18 AUD – 32 AUD depending on the way you set up your transfer + exchange rate markup + any relevant intermediary fees

Different fees apply for payments to the Cook Islands, Fiji, French Polynesia, Kiribati, New Caledonia, Papua New Guinea, Samoa, Solomon Islands, Timor Leste, Tonga and Vanuatu – double check your own account terms if you’re sending to these destinations.

ANZ exchange rate

You’ll notice that the rate you’re offered isn’t the same as the one you can find online with a Google search, or using a currency converter tool. What you find online is the mid-market exchange rate – the rate banks get when they buy currency themselves. However, most banks – like ANZ – don’t pass this rate on to customers. Instead they add in their own fees and costs to calculate a retail exchange rate, which means you pay an extra fee here.

ANZ international transfer limits

Online you can send 1,000 AUD to 10,000 AUD depending on how your account is set up. You can change your transfer limit in online banking if you need to.

NAB international transfers

NAB has no international transfer fee for online payments, as long as you’re sending in a foreign currency. If you’re arranging your payment in AUD a fee will apply. Where NAB carries out currency conversion for your transfer, there will be a fee included in the exchange rate used to convert to the currency you need. However, in most cases, NAB will cover the intermediary fees which would normally be payable, which is an added bonus.

| Pros | Cons |

|---|---|

|

|

NAB transfer fees

NAB international transfer in a foreign currency (online): Transfer fee waived – exchange rate markup + any relevant intermediary fees will still apply

NAB international transfer in AUD: 30 AUD transfer fee + exchange rate markup + any relevant intermediary fees

NAB tries to cover the intermediary fees charged whenever you send a payment online. However, sometimes this is out of the control of NAB, and so you’ll end up covering those fees from the send amount.

NAB exchange rate

The NAB exchange rate includes a markup on the mid-market exchange rate. That’s an extra fee.

NAB international transfer limits

NAB transfer limits vary by account type. You can see – and manage – your transfer limits in your online banking service.

St George Bank international transfers

St George Bank allows customers to send payments overseas in either a foreign currency or in AUD, although the fees for these options do differ. When you send a payment in a foreign currency, St George will convert your AUD to the currency needed – and there’s a fee added into the exchange rate used. That can push up your costs overall.

| Pros | Cons |

|---|---|

|

|

St George Bank transfer fees

Send a payment in a foreign currency: 10 AUD transfer fee + exchange rate markup + any relevant intermediary fees

Send a payment in AUD: 20 AUD transfer fee + exchange rate markup + any relevant intermediary fees

St George Bank exchange rate

The St George Bank exchange rate includes a markup on the mid-market exchange rate. That’s a fee for currency conversion, but it’s hard to spot because it’s rolled up into the rate you’re offered for your payment.

St George Bank international transfer limits

You can send up to 50,000 AUD a day to international accounts with St George Bank.

Bendigo Bank international transfers

Bendigo Bank has a flat 30 AUD fee for telegraphic transfers, plus exchange rate markups and intermediary fees. Bendigo has an estimate of the intermediary fees which you’ll pay, which vary based on the currency, often in the region of the equivalent of 25 AUD to 50 AUD. This pushes up the overall fee quite significantly.

| Pros | Cons |

|---|---|

|

|

Bendigo Bank transfer fees

The standard Bendigo Bank fee for an outgoing telegraphic transfer is 30 AUD. In addition, intermediary fees can apply, which Bendigo estimates can be 25 AUD to 30 AUD. Exchange rate markups also push up the overall price you’ll pay.

Bendigo Bank exchange rate

The Bendigo Bank exchange rate includes a markup which is an extra fee rolled up in the exchange rate you’re offered.

The rate you find when you run a Google search or use a currency converter tool is the mid-market exchange rate. However, this isn’t the same as the rate you’ll be given when you send an international transfer with Bendigo Bank. Instead, Bendigo Bank – like most banks – will add a markup to the mid-market rate to calculate their retail rate. That means a less favorable rate for you, and a little more profit for the bank.

Bendigo Bank international transfer limit

The amount you can send in an overseas payment with Bendigo will depend on your account type. You can often adjust your payment limits by calling the bank or logging into your online banking service.

Suncorp international transfers

There’s no upfront Suncorp fee to send an international transfer online. However, there will still be a charge in the exchange rate used to convert your AUD to the currency you need – and intermediary fees may also apply. It’s also helpful to note that payment limits online can vary, and include overnight limits, daily limits, and 48 hour limits. If you need to send a higher amount you’ll need to visit a branch – which means paying a higher fee.

| Pros | Cons |

|---|---|

|

|

Suncorp transfer fees

Send a payment online: Transfer fee is waived – exchange rate markup + any relevant intermediary fees still apply

Send a payment in a branch: 30 AUD transfer fee + exchange rate markup + any relevant intermediary fees

Suncorp exchange rate

The Suncorp exchange rate is likely to include a markup on the mid-market exchange rate you’d find on Google or with a currency converter tool.

Suncorp International transfer limits

You can send an unlimited amount in a Suncorp branch. For online transfers, a maximum of 50,000 AUD a day, and 100,000 AUD within a 48-hour period can be transferred. The only exception is overnight, when the transaction maximum is 20,000 AUD.

HSBC international transfers

HSBC Australia offers payments all over the world, online and in branch. There’s an 8 AUD fee for online payments, but it’s useful to know that intermediary fees – which HSBC estimates can be around 30 AUD per transfer – will also apply. These charges are deducted from the transfer as it’s processed, which means the recipient gets less in the end.

| Pros | Cons |

|---|---|

|

|

HSBC transfer fees

Send a payment online: 8 AUD transfer fee + exchange rate markup + any relevant intermediary fees

Send a payment in a branch: 20 AUD transfer fee + exchange rate markup + any relevant intermediary fees

HSBC has an estimated amount for correspondent bank fees by currency and country, which suggests you’ll pay an extra charge of around 30 AUD.

HSBC exchange rate

The exchange rate used by HSBC is likely to include a markup added to the mid-market exchange rate.

HSBC international transfer limits

You can usually send up to 50,000 AUD per day with HSBC Australia.

Conclusion: What is the best bank for international wire transfer?

Using banks for international wire transfers can be convenient and secure but is also often expensive thanks to complicated fees and poor exchange rates. It’s also not often the fastest option, with bank wires commonly taking several days to arrive, depending on the destination.

Specialist services like Wise and OFX are a good option for a faster payment which can be cheaper too. Compare a few options to see which works best for you.

FAQs on best bank to make an international transfer with

What is the best way to transfer money internationally?

There’s no single best way to send money internationally – but specialist digital providers like Wise, OFX or WorldRemit can often offer a lower overall cost compared to your normal bank.

What is the cheapest way to wire money internationally?

Sending a payment with a specialist online service may work out cheaper than using your banks. Compare a few options – you can often get an instant, no obligation quote, so it’s easy to see which works best for you.

Which bank does not charge wire transfer fees?

Some banks like NAB will sometimes waive international wire fees – but it’s worth remembering that there are likely to be extra costs added into the exchange rates applied in this case.

Which Australian banks accept international wire transfers?

Get paid from around the world into your Australian bank account – most major banks will let you receive an international wire to your account, although fees may apply. You can also check out online specialist providers like OFX, Remitly and Wise which often offer better rates and lower overall costs on international wire transfers.