How to Open an Australian Bank Account Online from Overseas

If you’re heading to live life under the Aussie sun or if you’re already here enjoying the laidback lifestyle, then opening an Australian bank account for your money is something you’ll want to do soon. It’s possible and in most cases very easy and inexpensive to open an Australian bank account if you’re an Australian resident. However, while it used to be pretty easy to open an Australian bank account before you relocate there, this service isn’t as widely available these days.

This guide walks through your options to open an Australian bank account as a non-resident, with major Australian banks and non-bank alternatives like Wise and Revolut.

In four short steps, here’s the easiest way to open an Australian bank account online:

-

1

Go to the website of the bank you've chosen. From there you will be able to fill in the details they need.

-

2

Have a permanent Aussie address. Banks require proof of residency and not all will accept an overseas one when you complete your application.

-

3

Scan and upload all of the requested documents including your passport and visa.

-

4

If you’ve been approved online before arrival, you’ll need to head to your nearest branch on arrival to verify your documents and complete your application.

If you’d like to know more about your options of the best banks in Australia and ways to open an account online then read on. This guide tells you everything you need to know!

Can I open an Australian bank account online from overseas?

There are four big banks in Australia. They are National Australia Bank (NAB), Commonwealth Bank (CBA), the Australia and New Zealand Banking Group (ANZ Bank), and Westpac. All used to offer options for migrant banking services, so people planning on moving to Australia soon could apply for their accounts before arrival.

This service has gradually been reduced. At the time of writing the only option to start your application before you more is with Commonwealth Bank. You can start your application 14 days before you arrive in Australia - but you’ll still need to visit a branch on arrival to show your ID and get your debit card issued.

You can always open an account with Wise, which is a multi-currency account provider that allows you to hold and transfer over 40 currencies. You can get AUD account details before you arrive to Australia, as well as EUR, GBP, USD, NZD, SGD, and CAD.

Can I open a bank account in Australia only with my passport?

No. You’ll usually need to visit a branch of your preferred bank with documents including your passport, visa and a proof of local address.

Which account is best in Australia for foreigners?

There’s not one best account for foreigners in Australia - a lot will come down to your personal preferences and situation. Here’s a quick side by side comparison on some popular options to start your research.

| Service | Wise | Revolut | Westpac | Commbank |

|---|---|---|---|---|

| Multi-currency account options | Yes | Yes | Not in standard current accounts | Not in standard current accounts |

| Open before you arrive in Australia | Yes | Yes | No | No |

| Open online | Yes | Yes | No | No |

| Opening fee | None | None | None | None |

| Fall below fee | None | None | 5 AUD/month if you don’t hold 2,000 AUD | 4 AUD/month if you don’t hold 2,000 AUD |

| Maintenance fee | None | Variable depending on location and account plan - Standard accounts usually have no maintenance fee | 5 AUD/month | 4 AUD/month |

| International transfers | From 0.33% | Variable depending on location and account plan | No fee online, 32 AUD in branch | No fee online, 30 AUD in branch |

| Close account fee | None | None | None | None |

Getting an account with an Australian bank can be a good idea if you’re a resident there already and need to access a broad range of local financial services like a credit card or loan. However, if you’re not a resident yet - or if you want to be able to hold and exchange multiple currencies in one account - a non-bank alternative may be a better fit. Check out options like Wise and Revolut which both let you hold and exchange AUD alongside other currencies, with accounts you can open from a good range of countries around the world.

Best online option if I live overseas?

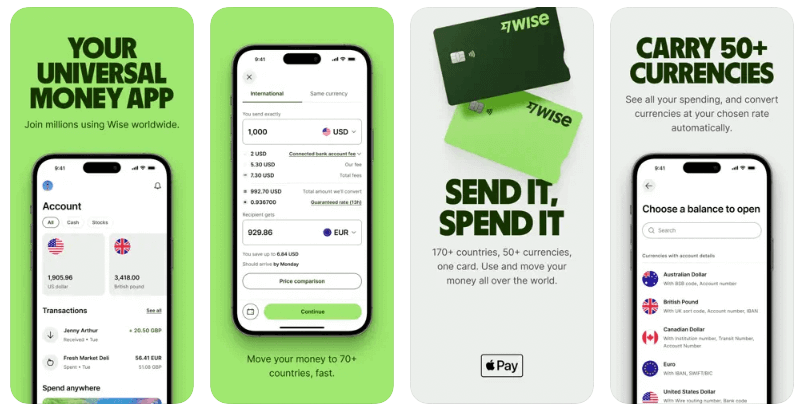

If you need ways to manage your money in AUD before you arrive in Australia, take a look at the Wise multi-currency account.

The Wise Account

The multi-currency Wise account has no set up fees, no monthly fees and no receiving fees for payments in AUD.

With broad availability to people in countries and regions including Europe, the UK, USA, Singapore, Canada, Australia and New Zealand, this account allows you to get local account details for anything up to 19 currencies. Plus it holds over 40 currencies and also comes with a debit card so you can withdraw money from your account. The exact services and features available can vary based on where in the world you are, but the option to hold, send, receive and spend AUD is offered in most Wise accounts.

Although you’ll probably still want to gete a bank account if you’re in Australia for an extended time, this is a great option if you’re looking for something to temporarily hold your currencies while you settle in.

For more information on the Wise Debit Card, read our review.

What documents do I need to supply to the bank?

When applying online for an Australian bank account, you’ll need to supply documents that prove your identity and right to work and earn in Australia.

In most cases, these documents are:

- Your passport

- Your visa

- Proof of address

- Tax information e.g. TFN (Tax File Number)

- Employer details and salary

After you open your account, you will need to visit your chosen branch to verify your identity.

This appointment should be booked as soon as possible after you’ve completed your application – the sooner you can verify yourself, the sooner your bank account in Australia is open and ready to use. In this appointment, the bank may ask for documents such as:

- An Australian residential address if you provided an overseas one on your online application

- An Australian Medicare card or National Identity card (or other form of ID e.g. birth certificate)

What do I need to know before opening a bank account in Australia?

It used to be very easy to open an Australian bank account before you moved there - but these days you’ll struggle to get a bank account without being able to call into a branch in person. If you need an account to manage AUD payments before you have an Australian residential address and visa you’ll likely need to look at non-bank alternatives like Wise and Revolut instead.

How to choose the right account for you

If you’re living life down under already then you’re likely to have an idea of how accessible banks and ATMs are here. This is important to consider, but with each bank offering different packages and accounts, it’s definitely worth taking the time to understand which one suits you and your situation best.

Cheque, Savings or Credit?

Australia’s banking system uses EFTPOS (Electronic Funds Transfer as Point of Sale) rather than a debit card system. Essentially the same, EFTPOS is native to Australia and New Zealand and is a very easy way to pay for goods during your stay.

There are three main types of accounts available to you in Australia, and it’s important to know the difference as you’re generally asked which account you’d like to use to pay for most items.

Here's our take on them:

Cheque – A standard current account for everyday purchases. Linked to your EFTPOS or debit card, money will be deducted from your current account.

Savings – A savings account is a great option to put some money aside and is usually opened together with a current account. This account allows you to earn some interest on the money you're holding in your account.

Credit – A credit card will be harder to get in Australia and dependent on more factors than a cheque or savings account. If you do wish to get one, it will need to be a few months after you’ve settled in Australia so the bank can monitor your financial trends.

Best option when you're on a Working Holiday Visa

If you’re travelling on a Working Holiday Visa and need your account ahead of arrival, then you’ll probably be best off looking for non-bank multi-currency accounts with providers like Wise and Revolut.

Once you’ve arrived in Australia you can apply for an account with one of the big 4 banks we mentioned earlier - usually you’ll have to plan on staying in the country for a fixed length of time, so which account suits you might depend on how long you’ll be there.

Best option for Expats

If you are relocating with work, with your family or alone, then you might want to explore some of the features of other accounts Australian banks can offer. This can also be handy if you need to access additional features like credit or loans, which non-bank providers may not be able to help with. In this case you can’t get your account set up until you arrive in the country - but by preparing all your paperwork in advance you can hit the ground running on arrival.

Opening a Bank Account in Australia from New Zealand

Many New Zealanders make the move to Australia each year, and vice versa. The great news is, opening a bank account online in Australia from New Zealand is relatively easy. Because there isn't a huge time difference it becomes easier if you'd prefer to do it over the phone too. In addition to this, some banks work out of both New Zealand and Australia. For example, ANZ bank.

Before you leave New Zealand it's a good idea to check that the name on your passport matches your other forms of identification. This way you won't have any issues when you get to Australia and need to confirm your identity at the bank.

What are the fees of opening an Australian bank account online from overseas?

Australian banks have very minimal fees linked to them, whether you apply from overseas or in Australia. If you're looking to open your account, then it won't cost you much.

That being said, it’s important to know what you’re signing up for as banks are never completely free of charges. Here is a list of the common fees attached to the standard current accounts of all of Australia’s big four banks:

ANZ (Australia and New Zealand Bank)

ANZ provides everyday banking with their Access Advantage current account.

- Monthly fee:

$5/month

- Overdraft fee:

$100 upfront for an overdraft of <$20,000

For other account fees, click here for more information.

Commbank (Commonwealth Bank)

Commbank offer an Everyday Account Smart Access current account for shopping, paying bills, withdrawing cash and more.

- Monthly fee:

$4/month, 12 months free with new account

- Overdraft fee:

$15 per account per day overdrawn

For other account fees, click here for more information.

NAB (National Australia Bank)

NAB offers a Classic Banking current account. Once you have an Australian working visa you can apply through the migrant banking channel before you arrive in Australia. However, you won't be able to withdraw any money from your accounts until you get to Australia and visit a branch.

- Monthly fee:

$0

- Overdraft fee:

Variable based on overdrawn amount

For other account fees, click here for more information.

Westpac

Westpac has a Choice current account for everyday banking.

They are a great choice as they have a separate migrant banking section designated to help foreigners get set up ahead of their move to Australia.

- Monthly fee:

$5/month

- Overdraft fee:

$15 per account per day overdrawn

For other account fees, click here for more information.

Depending on what type of account/s you are wanting to open, the above fees should give you a basic idea of how much a standard current account will cost you.

When applying for a bank account, you will also want to consider additional fees so that you understand what you’re signing up for including ATM fees and international money transfer fees.

ATM fees

ATM fees can vary depending on who you bank with, but as all major banks operate networks of ATMs with no fees you should find it relatively easy to locate an ATM nearby which has no charge to pay. This also means you'll have many more options beyond your own bank's ATM and you'll be able to withdraw your money for free.

That being said, overseas withdrawals are likely to cost you so do check your account terms and conditions before you withdraw abroad.

International transfer fees

If you’re looking to open a bank account in Australia, you’re likely going to need to transfer some money from your current account back home to your new Australian account. Otherwise known as an international transfer, it can cost you a lot if you're not careful.

There are many options to transfer your cash in today’s technological world, and whether you’re looking for ease, value or just the fastest route, you’ve got a lot of choices.

A transfer through your bank will always have multiple fees which can include;

- An upfront fee

- A service fee

- A mark up on the exchange rate

If you’re looking for alternative ways to send your cash to your new Australian account, then we recommend using our money transfer comparison table to choose the best option to transfer your cash abroad.

How can I transfer money to Australia without a bank account?

There are ways to transfer money to Australia without actually opening a bank account there. Although there are many benefits of opening a bank account, your circumstances may not suit doing so. If you’re thinking of opening an international account for easy transfers to and from AUD, check out these alternatives to the big four banks:

Wise

Wise accounts allow you to hold, send, spend and receive AUD, and can be opened from many countries and regions globally. If you need to send or receive AUD payments, Wise is worth considering as you’ll get the mid-market exchange rate with low conversion fees from 0.33% whenever you need to exchange currencies to send a payment, or make a withdrawal.

Plus, you can hold and exchange 40+ currencies in your Wise account online and in-app, and get a linked Wise debit card for spending and withdrawals in 150+ countries around the world.

Revolut

Revolut offers a range of different accounts which can vary a bit based on where in the world you are - but which usually includes the Standard account which has no monthly fee to pay. For other account types you’ll pay a monthly charge to unlock more features.

Accounts let you hold and spend AUD alongside 25+ currencies and all get some weekday no fee currency conversion and ATM use every month. Once you exhaust your plan limit you pay a fair usage fee. Out of hours charges also apply if you exchange currencies when global markets are closed.

Conclusion: Open a bank account online in Australia

If you want an account with an Australian bank you’ll almost certainly have to wait until you live here and can show your visa and proof of address in a branch. Once you’re a resident there’s a great selection of account options and services from major banks - but if you’re looking to open an account as a non-resident or before your planned move, you may prefer a non-bank alternative like Wise or Revolut. Both let you hold and exchange many different currencies including AUD, with accounts you can open before you have an Australian address.

Open a Australian bank account online FAQs

Can a foreigner non-resident open an account in Australia?

You’re not likely to be able to open your account with a bank until you’re a resident in Australia - but you can still open an account with a non-bank provider like Wise or Revolut, to hold, spend and exchange AUD before you move.

How much do I need to open a bank account in Australia?

There’s not usually a fee to open a bank account in Australia - but to avoid the maintenance fees of major bank accounts you may need to have a set minimum balance of 2,000 AUD or more

Can I open an Australian bank account online?

As a foreigner you may not be able to open your Australian bank account online. Even where banks let you start the application online, you’ll normally have to visit a branch with your ID, address documents and Visa to get full access.

How to apply for a bank account online in Australia?

If you’re able to apply online for a bank account you can do so easily on your preferred bank’s website or app. Or, check out services like Wise and Revolut. They’re not banks - but they do offer AUD accounts with a fully online or in app application process.

Can I open a bank account in Australia before landing?

You can not usually open a bank account in Australia before you’re physically there. Instead, consider a non-bank multi-currency account which supports AUD and which you can open from your home country instead - check out Wise and Revolut as great starting points for your research.