Bringing inheritance money into Australia: What you need to know in 2025

Many of us have family members living outside of Australia. Maybe a relative emigrated and now lives overseas – or perhaps you’re a newcomer to Australia yourself, with family, friends and loved ones still in your home country.

If you have recently lost a loved one who lived overseas, you may be wondering what happens to their estate, and any inheritance you might receive. While administration is unlikely to be the first thing on your mind, there’s a good chance that you’ll have a few things to do if you’re involved in managing the estate and ensuring any legal or tax practicalities are sorted out.

In this article, we’ll look at the rules and procedures, as well as a step-by-step guide to help with receiving inheritance money from abroad.

Bringing an inheritance into Australia may have tax implications here or abroad. This guide is for information only and does not constitute advice. Get professional support if you’re unsure about your tax obligations overseas or in Australia – or call the ATO on 13 28 65, with your Tax File Number (TFN) for local advice here.

What are the rules for receiving inheritance from abroad?

When it comes to managing the estate of a deceased person, or managing an inheritance, the residence, tax status, and in some cases, nationality, of both the donor and the recipient matter.

If a loved one has died overseas, their estate will usually be subject to the local laws wherever they have residence and tax residency. Inheritance rules can vary extremely widely between countries, so it is likely that you’ll need an experienced local lawyer to help.

Tax may need to be paid on the estate before any of the funds can be distributed to next of kin, or people who have been named as recipients in the deceased’s will. Depending on the country, this could include inheritance tax – sometimes called death duty – or capital gains tax for example. Because some assets belonging to the deceased person are likely to continue to accrue in value after the individual’s death, there may need to be a tax return completed on this income before funds are released, too. This could apply if the person who has died had assets in an interest earning bank account, or was being paid dividends from investments, for example.

Once all of the legal requirements have been fulfilled overseas, the estate can be divided and passed over to the recipients. At this point the money can be moved, so you will be able to transfer any funds inherited to Australia.

What legislation applies to an inheritance from abroad?

If you are receiving an inheritance from abroad in Australia you may not need to declare it or pay tax on it to the ATO. Australia does not have inheritance tax or estate taxes at the time of writing, and funds transferring into the country as a result of a death overseas would not normally be taxed.

There are some important exceptions – including if you’ve inherited property from someone abroad. This means it’s worth double checking with a tax advisor before you receive any inheritance from overseas.

Once the inheritance is passed over to you, you’ll become liable for it from a tax perspective. That means you may need to report and pay Australian tax on income from the funds, or if you dispose of an inherited asset.

How to receive inheritance money from abroad: Step-by-step

When someone dies there are some important processes which need to take place to assess and distribute any funds or assets which are in their estate. Usually no funds will be released from the estate of a deceased person until the process has been completed, including paying any relevant taxes in the country the individual lived in.

If you’ve just lost a loved one, you’ll benefit from having a lawyer to help with the process – and even more so if the steps to be taken are unfamiliar and subject to international law. The exact way everything will work can depend on where the individual died – to give an outline, we’ll look at the common requirements here.

1. Identify the recipient of the assets

When someone dies, their will is likely to state who will be the recipients of any assets they hold. In some countries, there are specific rules which dictate who can inherit. The first step that will be taken when settling an estate is likely to be identifying who will execute the will and who will receive assets, and proving their identity and relationship with the donor.

It’s likely that any potential recipients will need to provide a photo ID document, and some evidence of their link to the deceased person, such as a birth or marriage certificate in the case of a close relationship.

2. Gather the documents

Before any action can be taken by the executors of a will, they’ll need to collect evidence to show the process they’re following is legally correct. The documents needed are defined by each country’s legislation, and will usually start with the executor applying for a Grant of Probate which identifies them as the individual dealing with the estate.

It is important to consult with the lawyer who will handle the case, to get the list of documents needed in the specific location, which usually include a death certificate for the deceased, a certified copy of their will and other official paperwork showing their assets.

3. Comply with tax obligations

Depending on the country involved, it may be necessary to pay taxes on the estate before any distributions can be made. The way different countries deal with the tax on the estate of a deceased person can vary extremely widely. Usually, the rules which apply will depend on the tax residency of the individual who has died, so getting local advice at this stage is crucial.

4. Decide how to receive the amount from abroad

Once probate has been completed and any funds in the deceased person’s estate can be distributed, you’ll need to work out how best to receive the money from abroad.

Whenever you’re receiving a payment from abroad for any reason, it’s important to note that there may be fees to pay, including costs involved with currency exchange. To minimise the costs you may decide to wait until the exchange rate is favourable, or you could invest some time in researching different payment providers which offer preferential rates and fees.

For many people the most cost effective way to receive money from overseas is to use the international transfer services of digital platforms. It is important to use a provider that is reliable and has good rates – here are a couple of examples of providers that allow sending and receiving money internationally, with low costs and fair exchange rates.

How to receive inheritance money from abroad with Wise

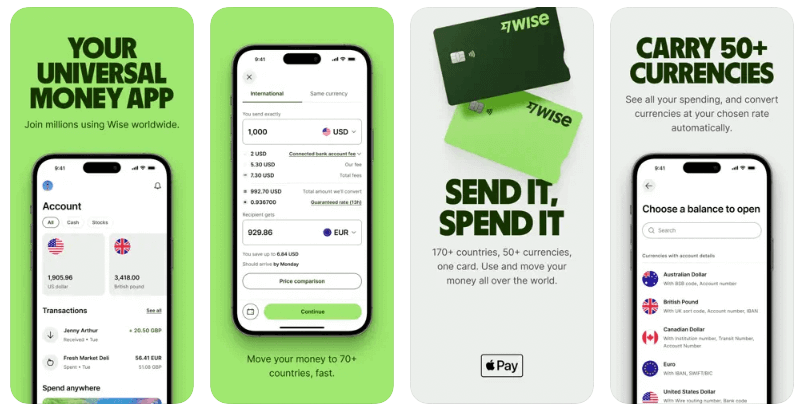

Wise is an international money transfer company which specialises in international transfers and multi-currency account services with low fees, and the mid-market exchange rate. In Australia, Wise is regulated by ASIC, APRA and AUSTRAC and holds an Australian Financial Services Licence. It’s also overseen by many similar bodies globally to make sure customers are safe.

If you need to receive a payment from abroad, there are 2 main ways of using Wise.

Receiving money in a Wise account

Wise accounts come with local and SWIFT account details to receive money in a broad selection of major currencies, including AUD, USD, EUR, NZD and GBP. When you open your account you can access your foreign currency account detailsand pass these to the person sending you money. They’ll be able to transfer the funds without needing to convert the money back to AUD. Hold your balance in a foreign currency or switch to AUD or 40+ other currencies, whenever the time is right.

Wise accounts come with local and SWIFT account details to receive money in a broad selection of major currencies, including AUD, USD, EUR, NZD and GBP. When you open your account you can access your foreign currency account detailsand pass these to the person sending you money. They’ll be able to transfer the funds without needing to convert the money back to AUD. Hold your balance in a foreign currency or switch to AUD or 40+ other currencies, whenever the time is right.

Here’s how to open a Wise account and get your foreign currency details to receive money to your account:

- Download the Wise app, or open the Wise desktop site

- Register with your email address, or an Apple, Google or FaceBook account

- Follow the prompts to enter your personal details

- Upload your ID documents and proof of address for verification

- Once your account is verified you can select Currency Balance and tap the currency you need, to open your foreign currency balance

- Your account details are available within the currency balance tab on the Wise app

Sending money to Australia using Wise

If you don’t want to receive your money to Wise, the person sending money can still benefit from the low fees and great exchange rates Wise uses, when sending funds to your bank account. Wise offers transfers to 160+ countries, including Australia, which are set up online or in the Wise app, and which can be deposited to bank accounts in a broad selection of currencies. In this case, you’ll simply need to give the person sending money your Australian bank account information including account number and BSB, as well as your bank’s SWIFT code.

Here’s how to send money to an Australian bank account with Wise:

- Download the Wise app, or open the Wise desktop site

- Register an account with your personal and contact details

- Upload your ID documents and proof of address for verification

- Within your account, tap Send Money

- Enter the amount you’re sending, and add AUD as the currency to be received

- Check the fees and rates and follow the prompts to confirm and pay

Note to reviewer, writers can ignore. Add a CTA button for Wise.

How to receive inheritance money from abroad through Revolut

Revolut has 30+ million users worldwide, and offers international money transfer and account services to individuals and businesses. You can open a Revolut account in Australia, or receive money through Revolut to your Australian bank account.

Receiving money with Revolut

If you open a Revolut Australia account you can request a payment from other people, or get your local or SWIFT account details to receive money in select foreign currencies. Just give your account details to the person sending you money and have them set up a normal transfer. You can hold 25+ currencies in your Revolut account, and all accounts have some no fee weekday currency conversion with the Revolut rate. Some accounts have monthly charges – but paying a fee does mean you get more features.

Here’s how to receive money with Revolut:

- Download the Revolut app

- Register an account with your personal and contact details

- Upload your ID documents and proof of address for verification

- Once your account is verified you can select Accounts and + Add new to open your foreign currency balance

- Your account details are available within the SWIFT tab on the app

Sending money to Australia using Revolut

If the person sending you money lives in a country where Revolut supports payments, they’ll be able to make a transfer right to your Australian bank account using Revolut. Revolut supports transfers to 100+ countries, with low fees and fast delivery.

Here’s how to send a payment to Australia using Revolut:

- Download the Revolut app

- Register an account with your personal and contact details

- Upload your ID documents and proof of address for verification

- Within your account, tap Payments, on the bottom of the home screen

- Enter the amount you’re sending, and add AUD as the currency to be received

- Check the fees and rates and follow the prompts to confirm and pay

Note to reviewer, writers can ignore. Add a CTA button for Revolut.

Tax implications in Australia

If you’ve received an inheritance from someone overseas and moved the money to Australia, there’s not usually any tax to pay in Australia. As we’ve mentioned already, there may have been taxes including inheritance tax and capital gains tax, to pay already, in the country the deceased person lived in.

Bear in mind though, that as soon as you’ve received the inheritance from abroad, Australian tax rules apply. If your assets earn income – interest or dividends for example – you’ll need to report and pay tax on this income as you would with any other income here in Australia.

How to declare an inheritance received from abroad?

Generally, an inheritance received from abroad does not need to be declared, and no taxes need to be paid in Australia. Double check the situation with your personal tax advisor or call the ATO if you are unsure about how the rules apply in your specific situation.

What is the deadline to settle inheritances from abroad?

Usually no tax applies in Australia when you receive an inheritance from abroad. Money you receive does become subject to ATO rules as soon as it’s in your possession though. That may mean you pay tax on income generated from your funds as soon as they’re legally yours.

Note to reviewer, writers can ignore. Add a banner with CTAs for Wise and Revolut.

Legislation applicable to foreigners who receive an inheritance in Australia

The laws which surround inheritance can differ a lot in different countries. If you’re receiving an inheritance, it’s also important to consider where your tax residency is, as this will impact any taxes owed on the payment.

If you are a foreigner with residence in Australia, including for tax purposes, most likely you will be subject to the Australian laws for receiving an inheritance from abroad. There’s no inheritance or estate tax in Australia, but capital gains taxes can apply if you inherit here and then sell the assets. Also, income tax applies on income generated by inherited funds or assets.

Because Australian inheritance and tax laws may differ from those in your country of origin, it’s important to have a lawyer to make sure that everything is being done correctly and legally when you inherit.

Conclusion

If you’ve inherited money after a loved one passed away overseas, you will need to consider the best way to help manage their estate and receive your inheritance to Australia. Getting advice – both here and in the country of the deceased person – is essential as the law can be complex, and the administrative burden can be high.

This guide should help you start to unpick what’s needed – and when it comes time to receive your inheritance from abroad, consider using providers like Wise and Revolut as alternatives to receive money from abroad with secure, fast and cheap payment options.

Note to reviewer, writers can ignore. Add a CTA button for Wise and Revolut.

FAQ

How to receive inheritance from abroad?

For many people the most cost effective way to receive inheritance from abroad is to use digital platforms like Wise and Revolut which have low costs and fair exchange rates. You can receive payments to your Australian bank in AUD or to a provider like Wise or Revolut in a broad selection of foreign currencies.

How to declare an inheritance received from abroad in Australia?

Generally, an inheritance received from abroad does not need to be declared, and no taxes need to be paid in Australia. Double check the situation with your personal tax advisor or call the ATO if you are unsure about how the rules apply in your specific situation.

Are there taxes to be paid when receiving an inheritance from abroad?

There are likely to be taxes paid in the country in which the deceased person had tax residency. These can include inheritance or estate tax, capital gains taxes and income tax. Once tax matters have been settled overseas, you can usually receive the payment without needing to pay more tax here. However, once the funds belong to you, you’ll be responsible for local tax – such as income tax on interest or dividends for example.