How to open a bank account in India: A Full Guide [2023]

Looking for a smart way to manage your money when you relocate to India? Or maybe you need a simple way to hold and exchange INR? Opening an account with a bank in India can be tricky if you’re not a resident – but the good news is that there are some alternative options available.

This guide runs through what you need to know about opening an INR account, including the documents you need, eligibility and the common costs. We’ll also take a look at how non-resident accounts from banks stack up against modern alternatives, like Wise or Revolut.

What documents do I need?

Let’s start with the basics. Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs) and Overseas Citizens of India (OCIs) can open Indian bank accounts without being resident in the country. However, if you’re not a resident of India and you don’t fall into one of these categories you may struggle to open an account with a bank.

The accounts available to NRIs, PIOs and OCIs are split into 3 types:

- Non-Resident External Account (NRE)

- Non-Resident Ordinary Account (NRO)

- Foreign Currency Non-Resident Account (FCNR)

The documents you need to open a bank account in India will depend on your residency status. You can expect to be asked for:

- Proof of identity (like a passport or ID card)

- Proof of address (if you’re an Indian resident this is likely to be your Aadhaar Card, although foreign proof of address is accepted for some account types)

- Proof of your status as an NRI, PIO or OCI (OCI or PIO card, passport, or birth certificate for example) if relevant

- Some accounts require you to have a PAN card

If you are in India as a legal resident but don’t have all the paperwork outlined above, you may still be able to open what’s known as a small account. These are limited accounts which come with basic functions only, but which need little more than a signature to get started.

Now onto the tricky bit – getting an Indian account if you’re not an NRI, PIO, OCI or a resident of India. In this case the chances are that you won’t be able to open an account with a regular Indian bank. Instead you may choose an account from a specialist provider which offers a multi-currency account which can handle INR. These accounts are usually cheap, convenient and flexible – and can be opened from Australia without even needing to leave home. More on that, next.

Save the paperwork with alternative solutions like Wise or Revolut

Opening an account to hold and convert Indian rupees with an Indian bank might be tricky if you’re not a resident. That’s where specialist services like Wise or Revolut can help.

Specialist online and digital accounts allow customers to hold and handle a range of currencies which can include INR. Depending on the provider you select you may also get an international debit card, low cost cross currency payments and more.

Open an account from a provider like Wise or Revolut from Australia, using your Australian documents and proof of address, to get an INR account almost instantly and without even leaving home.

How to open an Indian bank account as a foreigner

As we’ve seen, the rules about opening an Indian bank account largely depend on your residency status and whether or not you hold NRI, PIO or OCI status. If you’re eligible to open an account with an Indian bank, based on your status or residency, you’ll be able to do so in a branch or – sometimes – online.

You may also be able to start your application online and then complete it by visiting a branch or talking to a member of service staff on the phone.

Each bank has its own process for opening accounts – so it’s worth shopping around a bit to find the most convenient option for you.

What do I need to know before opening a bank account in India?

Whether or not you can open a bank account in India with a bank depends on your residency and status. It’s helpful to know that the accounts available to NRIs, PIOs and OCIs are split into 3 types:

- Non-Resident External Account (NRE)

- Non-Resident Ordinary Account (NRO)

- Foreign Currency Non-Resident Account (FCNR)

These account types can be opened remotely in many cases, so you don’t need to physically be in India to get set up. You may be able to download the application documents and mail them to the bank you’ve chosen from home, or you may need to visit a bank branch in Australia.

If you’re a resident of India and want to open a bank account, the chances are that you’ll need to visit a branch to get your account opened, with all the paperwork outlined above. Technically it’s possible to open an account online – but in practise this is usually tricky if you don’t have the standard paperwork used by Indian citizens.

Can I open a bank account in India only with my passport

You can not open a bank account in India with only a passport. Indian banks require extensive documentation to open an account, including proof of residency or NRI, OCI or PIO status.

If you’re not a resident in India and don’t have the relevant documents to open a non-resident Indian account, you may be better off with an alternative from a provider like Wise, which offers multi-currency accounts you can use to hold and exchange INR without needing Indian residency. More on that later.

Can I open a bank account in India before arrival?

If you’re an NRI, PIO or OCI you’re likely to be able to open a non-resident account with an Indian bank, which may be possible online or by mail prior to arrival. However, if you don’t fall into one of these categories you’ll probably need to open a resident account. That means you must have a local Indian proof of address, which is hard to get hold of before you’ve physically moved to the country.

Specialist providers like Wise or Revolut let you hold and exchange INR and can be set up from Australia before you arrive in India yourself. Read on.

Which account is best in India for foreigners?

India has a huge financial sector, with many banks and a broad range of account options available. However, as we’ve seen, the rules about who can open different types of account are pretty strict and can make it hard for a foreigner to get an account without being present in the country.

Aside from banks, customers can also look at specialist financial technology companies. These tend to be cheaper and more flexible than banks.

Let’s take a look at a few examples:

| Service | Wise | Revolut | State Bank of India | HDFC |

|---|---|---|---|---|

| Currencies covered | 40+ currencies including INR and AUD | 25 currencies including INR and AUD | INR | INR |

| Eligibility | Residents of a range of countries, incl. Australia | Residents of a range of countries, incl. Australia | Foreigners in India can open a residents account; some non-residents can open NRO/NRE accounts | Foreigners in India can open a residents account; some non-residents can open NRO/NRE accounts |

| Open before you arrive in India | Yes | Yes | NRI customers may be able to open remotely | NRI customers may be able to open remotely |

| Open online | Yes | Yes | No | Varies by account |

| Opening fee | $0 | $0 | Minimum balance amounts apply – varies by account type | Minimum balance amounts apply – varies by account type |

| Maintenance fee | $0 | Up to A$24.99/month | Varies by account type | Varies by account type |

| International transfers | Low fee, varies by currency | Fee varies by currency and payment value | 10 USD + currency exchange markup for online remittance | 500 INR – 1,000 INR depending on value of transfer |

Traditional Indian banks could be a good option if you’re already in India with a valid proof of address document. If not, you may find a better deal with an online specialist provider. Specialists often provide more flexible multi-currency accounts which are cheaper and easier to open.

Wise

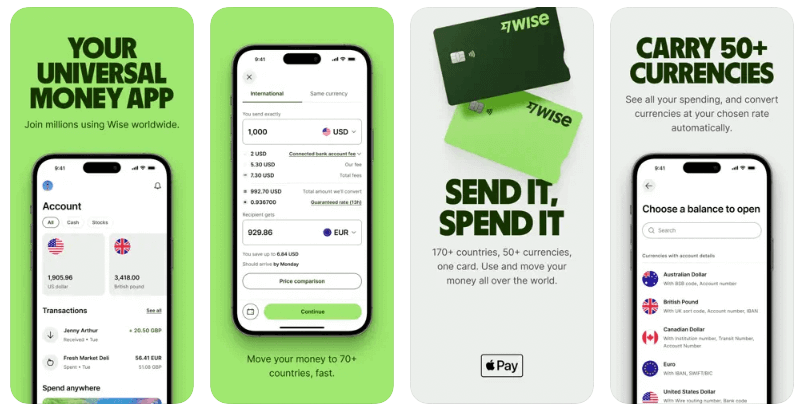

Wise is a financial technology company with a mission to make it easier and cheaper to send and receive international payments. 11+ million customers already use Wise to send money overseas, and for cheap and convenient multi-currency accounts.

Open a Wise multi-currency account online or in the Wise app from Australia, and you’ll be able to hold and manage 50+ currencies including INR. Currency exchange always uses the mid-market exchange rate with no markups, so you save significantly compared to using a traditional bank when you send a payment or shop internationally. You’ll also get a linked debit card, and local bank details for 10 currencies to get paid easily and with no fees from around 30 other countries.

Account types: Both personal and business customers can open a Wise multi-currency account with no minimum balance or monthly fees to pay. You just pay a low, transparent fee for the services you use.

Eligibility: Apply with proof of address from Australia to open and hold an INR balance. Full details of availability by location available on the Wise website.

Is it safe? Wise is regulated by ASIC, holds an Australian Financial Services License and is overseen by global bodies around the world.

How to open an account with Wise

To open a Wise account:

- Download the Wise app or open the Wise desktop site

- Click Sign up and create an account with your email, Facebook, Google or Apple ID

- Follow the prompts to enter the details needed

- Upload a snap of your ID and address documents

- Once your account has been verified you’re good to go

Revolut

Open and manage your Revolut account through the Revolut app, to hold and exchange INR as well as 26 other currencies.

Choose a free or fee paid Revolut account depending on the type of transactions you’re likely to make. Even free accounts have great features like some free currency exchange and a linked debit card. Extra benefits like lounge access and travel perks are available for customers who select the fee-paying account plans.

Account types: Standard account plans are free or you can upgrade to a paid plan for up to A$24.99/month.

Eligibility: Available to customers with addresses in the UK, the EEA, Australia, Singapore, Switzerland, Japan, and the US[10].

Is it safe? In Australia, Revolut is regulated by ASIC, and holds an Australian Financial Services License.

How to open an account with Revolut

To open an account with Revolut:

- Download the Revolut app

- Enter your phone number and set a PIN – you’ll get a verification message from Revolut

- Use the verification code to access the app and enter the details needed to create your account

- Upload the required documents for verification

- You can deposit funds and use your account once verified

State Bank of India (SBI)

One of the largest banks in India, with a significant presence outside of the country. Unsurprisingly SBI has a full range of accounts and products for different types of customers. If you’re a foreigner working in India you’ll be able to open a domestic resident account. Non residents, students and visitors will need to choose one of the non-resident account options – your options will depend on whether you intend to pay income into your account, among other things.

Open your account by visiting a branch in India or overseas.

Account types: Full range of accounts for residents and non-residents. However, eligibility criteria are tight so not all options are available to all customers.

Eligibility: Non-residents have the option of an NRE or NRO account, or a foreign currency savings account. Residents have small accounts and regular bank accounts to choose from, but eligibility is based on a range of factors and varies by account type.

Is it safe? Yes. SBI is state-owned, established, and trusted around the world.

How to open an account with SBI

To open an SBI non-resident account:

- Select the SBI account that suits your needs and check eligibility

- Download the application form from the SBI website

- Gather all the required documents and get attested copies where needed

- Submit your application by mail or by visiting a branch of SBI near you

HDFC

India’s largest private sector bank, HDFC has branches in India and a number of other countries. Accounts are offered for non-residents and residents alike, subject to strict eligibility criteria.

Technically, NRI customers can open an account online without the need to visit a branch. However, this is subject to having a full range of documents which have been fully attested. Opening an account remotely may be easier if you’re already a customer of HDFC looking to open extra accounts.

Account types: Full range of accounts for residents and non-residents. However, eligibility criteria are tight so not all options are available to all customers.

Eligibility: Eligibility depends on your residence status; non-resident customers will usually need to be NRIs, PIOs or OCIs to qualify.

Is it safe? Yes. HDFC is one of the largest banks in India and is considered extremely safe and trustworthy.

How to open an account with HDFC

To open an HDFC non-resident account:

- Select the HDFC account that suits your needs and check eligibility

- Download the application form from the HDFC website

- Gather all the required documents and get attested copies where needed

- Call HDFC for support of you wish to open the account on a non-face to face basis, or visit a branch to open face to face

What is a bank account in India needed for?

Having an Indian bank account can be helpful in lots of different scenarios:

- If you’re a non-resident Indian and want to receive and hold payments in INR

- If you’re planning to travel to India, or if you’re moving there to live or work

- If you want to convert funds to INR for investing or to diversify your savings

- If you need to send INR payments to others – such as paying for travel or an overseas mortgage

Benefits of opening a bank account in India

Still not sure about opening an Indian bank account? Here are a few benefits you can expect:

- Hold an INR balance without needing to convert to AUD unnecessarily

- Make simple INR payments to others

- Save and invest in the Indian market

- Access other financial services through Indian banks

Can I open a bank account online

You’re unlikely to be able to open an Indian bank account online from Australia. It is sometimes possible to open a bank account online in India if you’re an Indian resident, but for non resident accounts, it’s common to be asked to visit a branch or mail in copies of forms and documents to get started.

If you need to open an account online from Australia, to hold or spend INR, you may be better off looking at an alternative service like Wise or Revolut which offers digital multi-currency accounts which can hold, send, spend and exchange INR, AUD and a selection of 40+ other currencies.

How long does it take to open a bank account in India

The length of time it takes to open a bank account in India depends a lot on the type of account and whether you’re opening your account in person in a branch (in India or Australia), or mailing in paperwork.

You can expect the verification process to take some time, particularly if you’re sending in documents – so it’s worth double checking what’s needed in detail before you mail your application.

What are the types of bank accounts in India

As we’ve seen, there are various different account types that are available from Indian banks, depending on your situation. If you’re an NRI, OCI or PIO you may be eligible to open:

- Non-Resident External Account (NRE)

- Non-Resident Ordinary Account (NRO)

- Foreign Currency Non-Resident Account (FCNR)

If you’re an Indian resident you’ll have a full choice of account types, including day to day accounts, savings and fixed term deposits.

How much does it cost to open a bank account in India?

The costs associated with your Indian bank account can vary depending on the product you choose. Fee structures can be fairly complex so you’ll need to read your account terms and conditions carefully. Fees to look out for can include:

-

- Monthly maintenance fees – or fall below fees

- International payment fees

- Foreign transaction fees when spending or withdrawing with your card

- Overdraft fees

- Credit card costs including cash advances and interest

- Account dormancy or early closure fees

Specialist providers often offer more flexible accounts with no minimum deposit or monthly fees. You might also be able to access lower transaction fees, and a more intuitive user experience through online and in-app services.

Is it possible to open a fee-free account in India?

Bank accounts with no opening fee and no monthly fee are available in India. However, you’re still likely to run into transaction and service fees. Fee structures can be fairly complex so you’ll need to read your account terms and conditions carefully.

Tips for transferring money

Sending money overseas with an Indian bank can include several different fees including third party charges and a markup on the exchange rate applied. Before you move your money, check out these tips:

- Compare the exchange rate you’re offered against the mid-market exchange rate to see if a markup is being used

- Review the terms and conditions of your specific account to see the transfer fee which will apply – often there are several different payment types which all come with different fees

- Check if there are third party fees associated with the SWIFT network – these can push up the overall costs

Instead of sending your payment with your regular bank you might be better off sending your transfer with a specialist service like Wise.

Read also:

- How to open a bank account in Australia

- Opening a bank account in Singapore

- Opening a bank account in the US

- Opening a bank account in the UK

Conclusion

The rules about who can open bank accounts in India are fairly complex, which means that if you’re not resident in India and you’re not an NRI, PIO or OCI, getting a traditional bank account can be tricky.

You may find it easier to open a multi-currency account with a specialist online service like Wise or Revolut. You’ll still be able to hold and exchange INR but you will be able to get set up easier with a 100% online application and verification process. You’re likely to also benefit from lower fees and better exchange rates compared to a bank.

FAQ – How to open a bank account in India

Can a foreigner open an account in India?

If you’re a legal resident of India, or an NRI, PIO or OCI you’ll be able to open a bank account in India. Exactly what process you need to follow will depend on your residence status. If you don’t fall into any of these categories, you’ll probably find it easier to open an online account with a specialist provider.

How much do I need to open a bank account in India?

Some bank accounts in India have minimum deposit and minimum balance requirements. Others, including specialist services, may be completely free to open with no minimum balance – compare a few providers to get the best deal for your needs.

Can I open an Indian bank account online?

If you’re eligible to open an account and have a full set of attested documentation you may be able to open an account online with some traditional Indian banks. Alternatively, choose a specialist provider to open your account from home on your laptop or mobile device, with a more flexible verification process.

How to apply for a bank account online in India?

If you’re an Indian resident with a full set of required paperwork you may be able to open an Indian bank account online. However, if you’re not an Indian resident you may find it easier to get your INR account set up with an alternative service like Wise.

Can I open a bank account in India before landing?

NRI, OCI and PIO customers may be able to open an account as a non-resident. Other customers are likely to have to wait until they can prove their legal residence in India. Instead, why not get a smart and flexible account from an online specialist service like Wise or Revolut instead.