Using an NAB card abroad: All you need to know

NAB is one of the largest banks in Australia, with a comprehensive range of account and card services, as well as loans, mortgages, investments and more. If you have an account with NAB in Australia and are planning to travel or move overseas, you’ll need to know how to use your NAB card abroad. This guide walks through all the details.

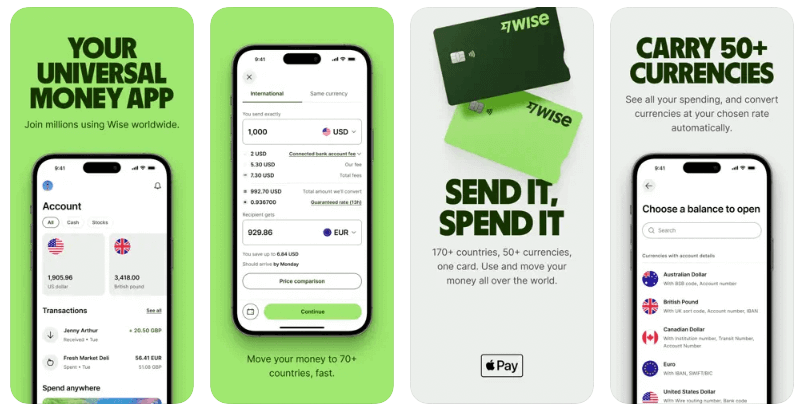

We’ll cover how to get an NAB card, what it costs to use an NAB card abroad, and how to make sure your card is activated for international use. Plus, we’ve got a brief introduction to an alternative – Wise card – which offers a low cost travel debit card with no foreign transaction fee, and which can be handy for spending in foreign currencies in person and online.

Can I use an NAB card abroad?

Yes. You can use your NAB card abroad if it’s been activated for overseas use.

Most NAB cards are issued on the Visa network which is one of the most broadly accepted networks globally. You can use your NAB card to spend and make withdrawals overseas as long as you’ve activated it for international use, which can be easily done in the NAB app. It’s also useful to make sure NAB has your full contact details before you travel, which can be checked in the app too.

It’s important to note that using an NAB card abroad might mean paying a fee. With the standard NAB Visa debit card, there’s a 3.5% foreign transaction fee which applies whenever you spend in a foreign currency. The NAB Visa Platinum card does not have a foreign transaction fee, but there is a monthly charge for this card, of 10 AUD. In both cases, there’s also a charge for international ATM use – making a withdrawal will set you back 5 AUD every time, plus any applicable foreign transaction fee, while a balance enquiry costs 1 AUD.

NAB credit cards can also be used abroad, but these are likely to have their own fees to consider, too. Using a credit card in an ATM for example will normally mean paying a cash advance fee and interest, as well as any relevant foreign transaction fee.

How to order a an NAB card

You can order a standard NAB Visa debit card linked to an NAB Classic Banking Account or an NAB Retirement Account. This card has no monthly fee. The alternative debit card from NAB is a Platinum Visa Debit Card which does have a fee of 10 AUD a month, but which will mean that foreign transaction fees are waived.

You can open your NAB account online and order your debit card to be mailed to your home address, as long as you’re over 14, an Australian tax resident, and have the required ID documents. You’ll need at least one piece of ID – and sometimes 2 documents are needed. Documents which are accepted include:

- A valid passport

- An Australian driving licence

- An Australian Medicare card

- Your birth certificate (for under 18s)

If you don’t have all of these documents you can open your account by visiting an NAB branch instead – call ahead to check that the documents you can provide are enough to open your choice of account.

Can I get an NAB card overseas?

Your NAB card will be delivered by mail to your Australian address. You can not order an NAB card to be delivered to any other country, and you’re unlikely to be eligible to open an NAB bank account if you’re not a resident of Australia already.

What happens if I move abroad?

NAB can help you if you’re moving to New Zealand, as you’ll be able to open an account with BNZ, which is wholly owned by NAB. You can get this organised even before you move, to ensure you have continuous access to your money. If you’re moving to any country other than New Zealand, you’ll need to close your NAB accounts and cut up your NAB debit and credit cards.

An alternative to NAB abroad: Wise card

If you travel often, shop on international websites, or plan to move overseas, NAB might not be the right choice for you. Using an NAB card abroad is possible but may end up expensive – and if you’re moving on a longer term basis, you’ll likely need to close your NAB account entirely.

Consider getting a specialist international account and card from a provider like Wise instead. Wise accounts can hold and exchange 40+ currencies, with a Wise card you can use for spending and withdrawals in 150+ countries. There’s no foreign transaction fee to pay with Wise. Instead, you can add money to your account in dollars and convert to the currency you need using the mid-market rate and a low Wise fee from 0.33%. Or leave your balance in AUD and let the card convert for you when you spend or withdraw, with the same great exchange rate and low fees.

Will my ATM card work abroad?

If you have activated your NAB card for overseas use, you can use it in an ATM abroad. However, fees will apply. There’s a 5 AUD fee for overseas debit card withdrawals, plus a 3.5% foreign transaction fee for standard NAB Visa debit cards. The ATM operator might also charge you a fee.

Consider getting a travel optimised card for overseas use, instead. With the Wise card you can make 2 withdrawals, to a value of 350 AUD a month with no Wise fee*, before costs apply. There’s no foreign transaction fee – just a low conversion fee which varies by currency and starts from 0.33%.

*Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks

How can I avoid ATM fees abroad?

NAB debit cards don’t have ATM fees if you use an in-network ATM in Australia, but when you travel you’ll pay a 5 AUD fee for a withdrawal, and there’s a 1 AUD fee just to check your balance. This can quickly mount up, so choosing a different card to avoid ATM fees when you travel is a smart plan. Consider getting a specialist travel card such as the Wise card for low or no cost ATM withdrawals overseas.

Tips for saving on your travel budget for abroad

Let’s wrap up with a few more tips on making your money go further when you travel:

- Planning is key – book the big ticket items like flights and hotels as early as possible to get the best available deal on cost

- Book your luggage at the same time as you book your flight – adding on a case later almost always costs more

- Make sure you know all the fees which might apply when you use your bank card overseas, including foreign transaction fees and ATM costs

- Check out cheap or free things to do in your destination, and look out for places to eat which are serving a local crowd rather than other tourists – this will usually be cheaper and can also be more authentic

- Get adequate travel insurance – it’s an extra cost but running into a medical emergency or losing your documents or belongings overseas would be far more expensive

- Consider getting a travel card with a provider like Wise to unlock great currency exchange rates and to avoid foreign transaction fees

What is the best currency to take overseas?

If you’re travelling abroad you won’t be able to use your AUD cash. If you’ve headed overseas with a wallet full of dollars you’ll need to switch them over to the local currency in your destination on arrival – which can be pretty expensive and time consuming.

While it’s reassuring to have some cash on you, many travellers prefer to use their bank or travel card overseas, rather than exchanging currency in advance or on arrival. You’ll be able to make ATM withdrawals when you need cash in the local currency, and you can use your card to tap and pay in stores, hotels and restaurants, too. You’ll need to check card acceptance rates based on the country you’re heading to – but in many cases cards are preferred, and even where cash is king, ATMs are plentiful in most towns, cities, airports and train stations.

While using your NAB card abroad might seem like the obvious choice it may not be the ideal way to manage your money when you travel – and it’s not an option if you’re relocating permanently. Check your NAB account to see what fees will apply when you travel – a 3.5% foreign transaction fee as well as higher ATM costs are standard with most NAB Visa cards, which can end up pretty costly. It may be worth considering an alternative, like Wise, which offers accounts and cards that have been optimised for international use, with low fees and the mid-market exchange rate.