The Best Foreign Currency Accounts in Australia in 2026

A multi-currency account (also called a foreign currency account) allows Australian residents and businesses to hold, manage, and transact in multiple foreign currencies from a single account. These accounts help you avoid repeated currency conversion fees, lock in favourable exchange rates, and simplify international payments—whether you're traveling, running a global business, or receiving payments from overseas.

Quick overview: Best foreign currency accounts in Australia

- Wise Account: Account and debit card with no monthly account fees, 40+ supported currencies and the mid-market rate for currency conversion

- Revolut Account: Choose different account plans which offer debit cards and multi-currency features, with some weekday exchange using the Revolut rate and no extra fee

- HSBC Everyday Global Account: Hold and exchange 10 currencies, with a debit card that offers cashback on some local spending and no extra charges to spend a currency you hold. HSBC exchange rate applies

- OFX Global Business Account: Business account to receive payments conveniently from customers abroad, with 30+ currencies supported, variable fees and Corporate Cards

Disclaimer: In this guide we’ve selected the best foreign currency accounts looking at overall costs, convenience, and flexibility. Other options may be available - and each customer will need to do their own research to find the perfect fit for their own unique needs.

What is a Foreign Currency Account?

Foreign currency accounts or multi currency accounts from your bank have a lot in common with your everyday transactional banking account. You can use them to receive money or pay money.

The biggest difference is that the account might hold other currencies, such as US Dollar, Euro or British Pound.

The providers we've selected to feature in this guide to the best multi-currency accounts in Australia allow you to hold anything up to 40+ currencies in the same place. You'll be able to view your balances in different currencies at a glance, and exchange between them when you need to.

Pros and cons of using foreign currency accounts

- Save money on currency conversion fees

- Hold multiple currencies in a single account

- Ability to open local accounts in local currencies

- International businesses can bill in foreign currency

- Buy currency ahead of time to avoid exchange rate moves

- Some accounts have monthly fees to pay

- Currency exchange may include a markup - a fee

- Other costs may be incurred when you transact - like ATM fees

- Many digital providers don’t allow you to deposit cash

Can a multi-currency account be opened in Australia?

Yes. You can open a multi-currency account in Australia, although it’s helpful to know that most of the foreign currency accounts from major banks like Commbank don’t offer multi-currency features. Instead you can hold one currency in one account - and would need to open additional accounts if you need access to more than one currency. That can get pretty cumbersome - but don’t worry: we've picked out a few options in this guide which are more flexible and allow you to hold several currencies in the same place, like Wise or Revolut.

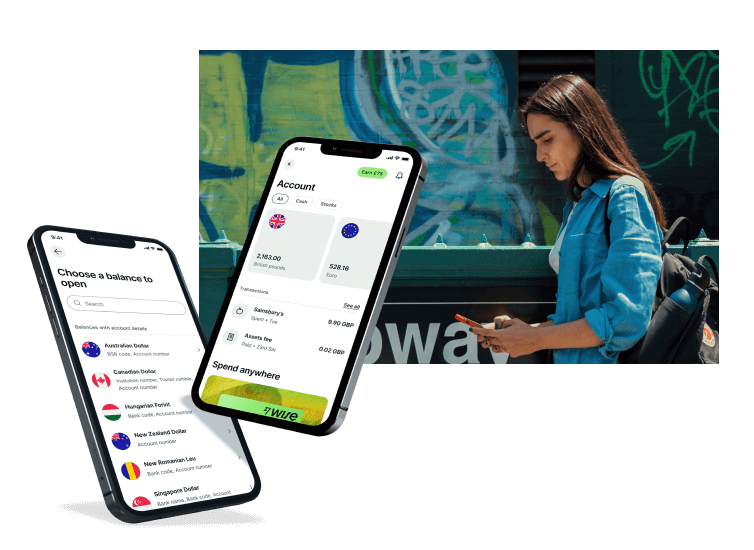

Wise Multi-Currency Account

Wise accounts are available for personal and business customers, and can be used to hold and exchange 40+ currencies.

You can add money to your account in AUD, receive payments from others in select foreign currencies, and either exchange to the currencies you need for transacting in advance or at the point of making a payment. Wise accounts offer a linked debit card and currency exchange uses the mid-market exchange rate with low fees from 0.63%.

Some transaction fees can apply, depending on how you use your account - but there's no maintenance fee and no minimum balance to worry about.

Account fees: No fee to open your account, no monthly fee

Currency exchange fees: From 0.63%, with the mid-market rate

Card fees: 10 AUD to order your card, no fee to spend a currency you hold in your account as long as you have enough to cover the cost of a transaction

ATM fees: Withdraw up to 350 AUD with no Wise fee, 1.75% + 1.5 AUD after that**

*Details correct at time of research - 27th November 2025

** Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks

Wise Account pros and cons

| Wise pros | Wise cons |

|---|---|

| ✅ 40+ supported curenices for holding and exchange

✅ Mid -market exchange rates with transparent fees ✅ No ongoing costs to pay, no minimum balance ✅ Intuitive app for managing your account and card |

❌ 10 AUD card order fee applies

❌ No in person or branch transaction option |

What customers say about the Wise account?

On Trustpilot, Wise scores 4.3 stars out of 5 - an Excellent rating. Here’s what one customer had to say about Wise:

"Absolutely 100% they are simply the best. Their site is easy to navigate and use, and to transfer and/or exchange currencies is fast and cheap.Buying online is a breeze.I cannot recommend highly enough. No other business comes anywhere close." (Max)

*Customer review taken from Trustpilot - the name of the customer was changed for privacy reasons.

Revolut offers 4 different personal account tiers, and further account options for business customers. All accounts support 25+ currencies for holding and exchange, and come with linked debit cards.

You may pay a monthly fee depending on the account tier you select, but all personal accounts come with some no fee currency exchange during market hours, and some no fee ATM withdrawals. Once you exceed the limit for your account tier, you'll pay a fair usage fee. Exchanging currencies outside of market hours also attracts an extra fee.

Account fees: 0 AUD - 28.99 AUD/month fees depending on account selected

Currency exchange fees: Some weekday conversion with Revolut rate before fair usage fee of 0.5% applies. Out of hours fees of up to 1% may also apply

Card fees: No fee to order or to spend a currency you hold

ATM fees: No Revolut fees to plan limit, then 2% (third‑party fees may apply)

*Details correct at time of research - 27th November 2025

Revolut pros and cons

| Revolut pros | Revolut cons |

|---|---|

| ✅ Choose different account plans depending on your needs

✅ All plans have some no fee transactions monthly ✅ Debit cards available for easy spending ✅ Hold and exchange 25+ currencies |

❌ Top tier accounts have 28.99 AUD/month fees

❌ 2% ATM fee applies once limit is exceeded |

What do customers say about Revolut?

On Trustpilot, Revolut scores 4.6 stars out of 5 - an Excellent rating. Here’s what one customer had to say about what they like about Revolut:

"The fact that it's so easy to use, I feel confident when using the card. Able to see what I'm spending and checking my balance." (Karen)

*Customer review taken from Trustpilot - the name of the customer was changed for privacy reasons.

HSBC Everyday Global

As a large global bank, HSBC has a multi-currency account you can open from Australia, to hold and exchange 10 currencies in one place. You’ll be able to get a debit card for local and international spending, and there’s no HSBC fee to spend a currency you hold in your account.

If you need currency conversion to cover the costs of a transaction, the HSBC live exchange rate will apply, which may include a markup. You can see the HSBC exchange rate in the HSBC mobile banking app before you transact.

Account fees: No HSBC fees to open or maintain this account

Currency exchange fees: HSBC rate applies which may include a fee, check live rates in the app

Card fees: No HSBC fees to spend a currency you hold

ATM fees: No HSBC fees to make withdrawals (third‑party fees may apply)

*Details correct at time of research - 27th November 2025

HSBC Everyday Global pros and cons

| HSBC Everyday Global pros | HSBC Everyday Global cons |

|---|---|

| ✅ No maintenance fees for this account

✅ Option to upgrade to a Premier tier if you choose ✅ Hold 10 currencies conveniently ✅ Make overseas transfers from your account |

❌ You may need to open an AUD account as well to access this service

❌ Exchange rates may include a markup |

What do customers say about HSBC?

HSBC doesn’t have a live profile on Trustpilot, but as a banking powerhouse, HSBC does regularly win awards, including Bank of the Year with Canstar in the everyday banking section, and a value led award for transaction accounts.

OFX Global Currency Account

OFX is a currency specialist which offers its Global Business Account for business customers and online sellers. This account supports 30+ currencies, and is especially marketed towards businesses getting paid through marketplaces like Amazon or PSPs like Stripe.

You can allow your customers to pay in their preferred currencies, and receive the money to your account without being forced to exchange back to AUD unnecessarily. Accounts also offer linked corporate cards.

Account fees: 0 AUD - 25 AUD monthly fee depending on the account tier selected

Currency exchange fees: Exchange rates may include a markup - a fee

Card fees: Physical card order fee 10 AUD, 1.5% fee overseas to spend a currency you don’t hold

ATM fees: ATM withdrawals not supported

*Details correct at time of research - 27th November 2025

OFX pros and cons

| OFX pros | OFX cons |

|---|---|

| ✅ 30+ supported currencies, with local account information in some currencies

✅ Some accounts have no monthly fee ✅ Send payments to suppliers easily ✅ 24/7 phone support if you need it |

❌ Monthly fees may apply depending on account tier

❌ ATM withdrawals not supported |

What do customers say about OFX?

On Trustpilot, OFX scores 4.3 stars out of 5 - an Excellent rating. Here’s what one customer had to say about what they like about OFX:

"An extremely efficient service that is good value for money, I particularly like the prompt messages that are sent at each step of the process. I’ve used OFX several times over recent years and have always been very pleased with the outcome." (Chris)

*Customer review taken from Trustpilot - the name of the customer was changed for privacy reasons.

How do foreign currency accounts work?

Foreign currency and multi-currency accounts can offer the option to hold and exchange multiple currencies in one account. This means you can mitigate exchange rate fluctuations by exchanging currencies when the rate is favorable, for example if you know you have a trip or an overseas payment coming up. You can also often get a linked debit card which allows card spending when you travel with no extra costs as long as you have the currency you need in your account (third‑party fees may apply).

How to open a foreign currency account

Here’s how to open a foreign currency account:

![]()

Step 1: Register

Register your personal or business details through your bank or with your preferred specialist provider. You will choose the type of account you need, your details and the currencies you'll transfer.

Step 2: Get verified

You’ll need to provide a proof of identity and address to verify your account - you can do this in person or by uploading a photo of your documents if you choose a digital provider. Once you provide some ID, your bank will let you know when your account is ready.

![]()

Step 3: Add money and order a card

Add money with a card or bank transfer to move money into your foreign currency account. You can arrange for this online, over the phone, or in-person at your bank branch to make the transfer. You can also order your debit card to be mailed to your home address - a fee may apply for this service.

When should I use foreign currency accounts?

Foreign currency accounts are valuable for anyone who regularly transacts in foreign currencies. Consider opening one if you:

For businesses:

- If you need to send payment to suppliers overseas, this can help limit currency costs

- If you get paid by foreign customers you can receive transfers in a selection of currencies

- If you have excess cash you can hold it in different currencies to save for future payments and avoid the risks of changing rates

For individuals:

- If you travel often, using a foreign currency account and card can allow for cheap secure spending abroad

- If you receive remittances or payments from overseas, multi-currency accounts can let you receive without needing to convert to AUD

- If you have overseas bills or need to send payments, a foreign currency account is convenient and often cheap

Which banks have foreign currency accounts in Australia?

No single multi-currency account is 'best' for everyone—the right choice depends on your specific needs, transaction volume, and whether you need personal or business features.

You can get a multi-currency account from a specialist provider, such as Wise or Revolut. Or you may be able to open a multi-currency account from a large global bank like HSBC to hold and exchange a selection of different currencies.

So can I open a multi currency account in Australia?

Yes. You'll have to hold a local Australian dollar account first if you choose to set-up your foreign currency account with your bank. Or you could open a digital account with a provider like Wise or Revolut instead.

For more tips, tools and information, go to The Essential Guides to Foreign Exchange for Business. You can also head to the Australian government website EFIC. It gives a good run down of these accounts from an exporters point of view.

Here is a list of some of the best multi currency accounts available in Australia:

| Account | Eligibility | Fees | Debit card | Best features |

|---|---|---|---|---|

| Wise | Personal and business customers | No fee to open or maintain the account; 10 AUD card order fee; currency conversion from 0.63% | Available | Hold and exchange 40+ currencies, get paid with local details in 8+ currencies |

| Revolut | Personal and business customers | 0 AUD - 28.99 AUD/month fees; some fair usage and out of hours currency conversion fees may apply | Available | Hold and exchange 25+ currencies, choose from 4 different account tiers based on your preference |

| OFX Global Currency Account | Business customers | No fee to open or maintain the account; currency exchange may include a markup | Not available | Hold and exchange 7 currencies, access currency risks management products and services |

| HSBC Everyday Global | Personal customers | No fee to open or maintain the account; currency exchange may include a markup | Available | Hold and exchange 10 currencies, no HSBC fee for international spending or cash withdrawals |

*Details correct at time of research - 27th November 2025

Writer’s tip - What's important when choosing a foreign currency account?

The range of currencies is important when choosing a foreign currency account - make sure the one you like offers all of the currencies you need for any planned payments or travel. Next look at the account fees, including monthly costs, card order costs, and also currency conversion costs. Compare the exchange rate offered by the account against the mid-market rate online, to see how it measures up. Getting an account with the mid-market rate - or as close as possible to it - is usually the best deal available.

What is the eligibility for a foreign currency account?

Before you sign up for a multi-currency account check the eligibility rules. Some accounts with major banks have pretty high minimum balance requirements, and may also have associated fees. This usually means they’re targeted towards business customers and high wealth individuals.

For the accounts we've covered above, HSBC offers services to Australian residents aged 16 or above for personal use. Wise and Revolut are both businesses which work across multiple regions, so you can apply for a personal or business account from Australia or many other countries, using your local ID and address - just bear in mind that the features and fees may vary depending on where in the world you are. OFX offers services to business customers only, although you can also apply from a pretty broad range of countries if you have a business registered overseas.

Foreign currency account fees & charges

The most common charge is the monthly account-keeping fee however it may not be the one to watch out for.

Most banks charge you when currency comes into the account AND when you send currency out. For a business that has a lot of payments and receipts in foreign currency, this fee can add up quickly so be careful to monitor it thoroughly.

If you are buying currency to put into your foreign currency account, make sure you check the exchange rate. It can make a huge difference depending on the amount you're buying.

How to compare Australian bank foreign currency accounts

To compare foreign currency accounts, it's important to look at the key conditions, fees and features. Here are the main ones:

- Minimum balance requirements – Some banks have minimum balance conditions to open an account, so make sure you'll have enough money to open an account.

- Interest – If you’ll be using an account for saving, check out the interest rate, which may vary depending on the balance in your account.

- Monthly fees – Some banks and providers offer foreign currency accounts without monthly fees, but not all options are fee free.

- Being able to deposit and withdraw cash – Digital providers don’t offer cash deposits - and not all banks accept foreign cash payments, either. If you need to get cash from an ATM make sure the account you pick has a debit card included.

- Access to a Foreign Currency Overdraft – Not every bank offers this product, and generally it’s not an option with digital providers.

- Multi-currency accounts – International banks may offer multi-currency accounts - digital services like Wise and Revolut do as well. This allows you to have multiple currencies that are held in the one account. Multi currency accounts are a great product, but make sure to check the charges and conversion costs if you transfer currencies between one to the other.

| Account name | Minimum balance | Monthly fees | ATM fees | Transfer fees | Available currencies |

|---|---|---|---|---|---|

| Wise | None | None | Withdraw up to 350 AUD with no Wise fee, 1.75% + 1.5 AUD after that** | From 0.63% | 40+ currencies including AUD, USD, GBP and EUR |

| CBA | None | None | No debit card offered | No fee online, 30 AUD in branch | Most convertible currencies supported |

| NAB | None | None | No debit card offered | No fee online, 30 AUD in branch | 16 major currencies |

| Westpac | None | None | No debit card offered | Variable fees online, 32 AUD in branch | 12 supported currencies for online opening - others available in branch |

*Details correct at time of research - 27th November 2025 - taken from CBA, NAB, Westpac

** Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks

Foreign currency accounts for business

Exporters and billing in foreign currency

Weigh up if the cost of running the account is worth the benefits. If you are receiving under $500,000 a year, or are receiving payment in foreign currency as a one-off, you may want to consider some other options:

- Bill in foreign currency, but get your customers to pay into your Australian dollar account. It's important to note that some banks will charge to receive the currency.

- Bill in foreign currency and use a specialist currency provider like Wise or OFX to convert the money. This may be a lot cheaper than sending it to your Australian dollar bank account and easier than opening a foreign currency account.

- Ask your customers to pay you in Australian dollars. It’s an easy option for you, but be aware that it could put your customers offside. They may want to pay you less, given they are now having to pay in a currency that is foreign to them and exposes them to currency exchange rate risk.

Importers or buying goods from overseas

If you need to send money overseas, but also have the receipts in the same currency, a foreign currency account is really useful.

Importers usually use a foreign currency account to buy currency when they feel it is at a good rate. They hold it in the account until the payment is due. It effectively locks in the exchange rate, but it’s important to note that it also comes with a few drawbacks.

- Buying currency and putting it in a foreign currency account ties up your Australian dollar cash-flow.

- While the currency is sitting in the account, it usually won’t accrue any interest and can’t be used in the running of the business.

- If you buy the currency at what you think is good exchange rate and it continues higher, you may have locked in an unfavourable rate.

There are other alternatives that will protect your business against exchange rate movements, without locking up your cash-flow. Talk to a currency expert or contact a foreign exchange specialist at your bank or currency provider.

Read also:

Conclusion

Opening a multi-currency account has advantages for anyone who transacts in foreign currencies regularly - whether that's when travelling, shopping online, or sending and receiving payments. Having a specific multi-currency account - rather than a foreign currency product which only supports holding a balance in one currency - is flexible and may mean you can do more with your account. Use this guide to see if there’s a good multi-currency account out there for your specific transaction needs, to cut your costs when you send, spend, receive or exchange foreign currencies.

FAQs

Can I open a multi currency account in Australia?

Yes. You can open a multi-currency account in Australia with a specialist service like Wise or Revolut, or with a global bank like HSBC. Major Australian banks often offer foreign currency accounts but these may not be true multi-currency products - you'd need to open several accounts if you need to transact in a selection of currencies regularly.

How much does it cost to open a multi-currency account?

There’s not usually a fee to open a multi-currency account, although some bank foreign currency accounts do have a pretty high minimum deposit amount. Check through the account fee schedule carefully before you sign up - transaction fees will apply even when there’s no specific account opening or keeping fee.

What is the difference between a multi-currency account and a foreign currency account?

A multi-currency account allows you to hold multiple currencies in one place, while a foreign currency account is usually intended to hold only one foreign currency. This means you need to open more than one account if you need to hold more than one currency.

Do I need an ABN to open a business foreign currency account?

You are likely to be asked for business registration information - which may include an ABN - when you open your business foreign currency account. This isn’t always needed, so do check with your account provider based on your business type and registration location.

Can I open a foreign currency account as a non-resident?

You can not usually open a foreign currency account with a bank as a non-resident but you may be able to open an account with a digital provider like Wise or Revolut instead. These providers offer multi-currency accounts to people with addresses in many countries, with access to dozens of currencies.

Listed sources

We used publicly available fee schedules and provider pages; last verified 27th November 2025. Fees change—always check the provider’s official page.

Wise - card information for Australian customers

Wise - pricing page for Australia

Revolut - plan options for Australian customers

HSBC - Everyday Global Account fees and information

OFX - Global Business Account landing page

OFX - business pricing page

CBA - foreign currency account landing page

NAB - foreign currency account landing page

Westpac - foreign currency account landing page

Your currency knowledge centre

5 Cheaper Ways to Transfer Money Overseas

Using a bank is one of the easiest ways of transferring money overseas, but can also be the most costly. There are alternatives that can make the whole process cheaper.

- Read more ⟶

- 2 min read

International Money Transfer Comparison and Reviews

Find the best international money transfer exchange rates to send money overseas from Australia. Compare the rates and fees from leading banks and money transfer services.

- Read more ⟶

- 6 min read

5 Good Alternatives to OFX

While OFX is easy to use, and offer good exchange rates, other companies can do the same. In this article, we take a look at companies that offer similar services to OFX to see how they stack up.

- Read more ⟶

- 2 min read