Wise vs CurrencyFair: A Full Comparison 2026

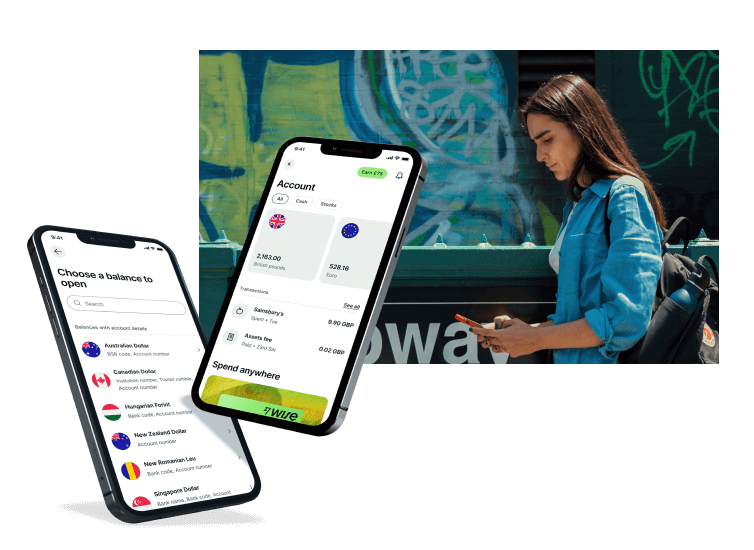

Wise and CurrencyFair both offer international payments, but they have different focus areas which may mean they appeal to different customer needs. Both serve both personal and business customers in Australia - but while CurrencyFair is a specialist in transfers only, Wise has transfers among a suite of other international services including multi-currency accounts and debit cards.

This Wise vs CurrencyFair review walks through all you need to know about their features, fees, services and safety, to help you choose.

Summary: Wise has multi-currency accounts you can use to receive, hold, send, spend and exchange 40+ currencies, and lets you send money to 160+ countries with the mid-market exchange rate and fees from 0.33%. CurrencyFair doesn't have holding accounts, but offers transfers to 150+ countries, with a flat fee and an exchange rate markup which is on average 0.53%.

CurrencyFair vs Wise: side by side

We’ll dive into the details of how Wise vs CurrencyFair work throughout this guide. First let’s take a head to head comparison on a few important features.

| Feature | Wise | CurrencyFair |

|---|---|---|

| Eligibility | Personal and business customers in Australia and many other countries | Personal and business customers in Australia and many other countries |

| Send international payments | Send to 160+ countries, 40+ currencies | Send to 150+ countries, 20+ currencies |

| Multi-currency account options | Hold AUD and 40+ other currencies

Local and SWIFT account details available for 8+ currencies |

Not available - when you send money to CurrencyFair it will be converted and transferred out to your beneficiary immediately |

| Debit cards available | Yes - Wise international debit card | Not available |

| Receive international payments from others | Yes - with local account details or SWIFT | Not available |

| Fully licensed and regulated | Yes | Yes |

So, to summarise:

- Wise and CurrencyFair both offer services to personal and business customers

- Wise and CurrencyFair both serve customers in Australia and many other countries globally

- Wise and CurrencyFair both offer international transfers - Wise delivers to slightly more countries and has more available currencies

- Wise has a multi-currency account and card to support 40+ currencies - CurrencyFair does not have this service

- Both providers are fully regulated and safe to use

The important bits

| CurrencyFair | Wise | |

|---|---|---|

| Rates | Markups are used - around 0.53% on average | Mid-market exchange rate with no markup |

| Fees | 4 AUD transfer fee | Low fees, varies by destination |

| Speed | Many payments arrive in 24 hours, although some can take longer | 50% of payments are instant, 90% arrive in 24 hours |

| Service | Online, in app and by phone | Online, in app and by phone |

| Safety | Fully regulated and licensed | Fully regulated and licensed |

| Reviews (TrustPilot). | Trustpilot score: 3.1/5, Average rating, from 7,000+ reviews | Trustpilot score: 4.3/5, Excellent rating, from 235,000+ reviews |

- Rates: Wise uses the mid-market rate, CurrencyFair has a small exchange rate markup

- Fees: Wise has variable fees for international transfer from 0.33%; CurrencyFair fees are 4 AUD - or the currency equivalent

- Speed: Wise payments can be instant, with 90% arriving in 24 hours. CurrencyFair transfers can take a day or two, depending on payment method and destination

- Service: Both providers offer multilingual service in a range of languages, online, in-app and by phone

- Safety: Both providers are fully licensed and regulated.

- Reviews: On Trustpilot, Wise gets an Excellent rating, CurrencyFair scores an Average rating

Pros and cons

| Wise | CurrencyFair |

|---|---|

| ✅ Send to 160+ countries, in 40+ currencies

✅ Mid-market exchange rates ✅ No ongoing fees or minimum balance requirements |

✅ Send to 150+ countries, in 20+ currencies

✅ Flat transfer fees on many routes ✅ Exchange rate margins can be fairly low ✅ Safe and regulated ✅ Business services available |

| ❌ Some transfer and transaction fees apply

❌ No cash based services |

❌ Exchange rates include a markup

❌ Delivery can take a day or more |

CurrencyFair Vs Wise: The verdict

Wise and CurrencyFair have a similar range of products on offer - the right one for you is likely to come down to the details of your payment.

CurrencyFair covers a really good range of 150+ destination countries, but only 20 or so currencies. While there’s a multi-currency account for personal customers, it’s not intended for holding money. Instead, it’s used to send in your funds in AUD so the money can be automatically converted and sent on to your recipient.

Wise offers the mid-market exchange rate for all transfers, which can make the pricing more transparent compared to CurrencyFair, and covers a broader 40+ currencies. Wise also offers a multi-currency account with 40+ currencies on offer and a linked international debit card.

If you’re looking for a day to day account to hold, receive, send and spend in foreign currencies, Wise may be your top choice. If you’re making a transfer, and both providers support international payments to your destination country, get quotes from each to compare and see which is your best bet.

About CurrencyFair and Wise

CurrencyFair was founded in 2010 in Ireland and has 150,000+ customers. You can make international payments for personal and business needs.

With CurrencyFair you can send payments to 150+ countries, in 20+ currencies.

Wise was launched as TransferWise back in 2011 as a low-cost international payment provider. These days, Wise has upwards of 16 million customers, and also offers personal and business accounts to hold and manage currencies, accept payments and spend using a linked debit card.

With Wise you can send payments to 160+ countries, in 40+ currencies

How do they work?

Here's how to make a payment online or in the app with CurrencyFair:

- Set up your transaction, adding the currency and amount you want to send and the currency you need your recipient to get in the end

- Follow the prompts to add recipient details

- Confirm how you want to pay - BPay or a local bank transfer

- Send your payment to CurrencyFair, and the money will be passed on to your recipient as soon as the funds have cleared

The amount of time it takes for your payment to be delivered with CurrencyFair will depend on how long it takes your money to be received by CurrencyFair, and the processing time of your recipient's bank. As soon as the funds are cleared they'll be released to the recipient - this may take anything from a few hours to a day or two depending on the destination and specific bank.

The process for sending money with wise is relatively similar - here's how you make payments online and in the Wise app:

- Log into your account

- Type in how much you want to transfer, or how much you need the recipient to get

- Enter the recipient's details - bank account number or email

- Check over the details

- Fund your payment using a card or bank transfer

- Confirm and your money will be on the move

Wise transfers are made through Wise's network of local bank accounts, so they arrive faster and don't incur intermediary fees. When you want to pay for your transfer in AUD you'll send the money to Wise's local Australian account. Then Wise will make a payment of the equivalent amount in your preferred currency, from their account in the destination country. No money actually moves across borders, so it's faster and cheaper than traditional international payments.

Wise vs CurrencyFair: which is cheaper?

Using a specialist provider is usually cheaper than choosing to send an international payment with your normal bank. However, the services, exchange rates and fees on offer from specialist providers do vary significantly - so shopping around is still a smart move.

Here's a look at how CurrencyFair and Wise measure up on a few different transfers. In these examples, we are sending a payment direct to a recipient bank account, funded by bank transfer.

| Amount & Currency | CurrencyFair | Wise | Winner? |

|---|---|---|---|

| AUD>1000 USD | 1,403.79 AUD | 1,399.52 AUD | Wise |

| AUD>5000 USD | 6,996.59 AUD | 6.994.44 AUD | Wise |

| AUD>1000 EUR | 1,593.57 AUD | 1,589.62 AUD | Wise |

| AUD> 5000 EUR | 7,948.77 AUD | 7,946.01 AUD | Wise |

*Rates and fees correct at time of research - 8th January 2022

In the examples above, Wise came out on top every time. Choosing between the 2 providers may come down to your personal preference, and where you're sending money to.

Wise vs CurrencyFair international transfer limits

Both Wise and CurrencyFair have limits which are set for security purposes, and which help to keep customer accounts safe. Wise limits vary by currency, but are usually around the equivalent of 1 million GBP, allowing both personal and business customers to transact freely. CurrencyFair does not disclose the limits which apply to account transfers. If you run into a limit when you’re sending a payment, you'll be notified in the app or online.

Sending large amount transfers

Let’s take a look at the options for sending higher value payments with both Wise and CurrencyFar.

Wise high amount transfers

If you send more than the currency equivalent of 20,000 GBP a month (around 38,500 AUD) you could get an automatic discount of up to 0.17%. There’s no need to pre-arrange the fee, which means everyone gets the best possible deal, every time. Here’s how the Wise high value payment discounts break down:

| Payment volume (GBP) | Discount |

|---|---|

| Under 20,000/month | 0 |

| 20,000 – 300,000/month | 0.1% |

| 300,000 – 500,000/month | 0.15% |

| 500,000 – 1million/month | 0.16% |

| 1 million+/month | 0.17% |

Wise Vs CurrencyFair: which is faster?

CurrencyFair international transfers are often ready within 24 hours. The exact time it takes for your money to be delivered will depend on how you fund the payment and where it's headed. There's a country by country rundown of anticipated delivery times on the CurrencyFair website to help.

Wise payments can arrive in seconds on some currency routes, and most transfers arrive within a day. You'll see the estimated delivery time when you set up your transfer, and can always track it online or in the Wise app.

Ease of use

- Creating an account: CurrencyFair and Wise accounts are opened and operated online or using the provider's app.

- Making a transfer: CurrencyFair and Wise international payments can be made online or in the Wise app.

- Ways to send money: CurrencyFair payments can be made by BPay or bank transfer. Wise transfers can be funded by bank transfer, credit or debit card.

- Languages: CurrencyFair has phone and email support in a range of languages. Wise offers global support in a range of languages, online, using the app, and by phone.

- Minimum & maximum amounts: CurrencyFair doesn't publish specific transfer limits, although some destination countries may be subject to local limits based on regional rules. Wise limits depend on which currencies you send to and from, and how you pay. However, you can make several smaller transfers if your ideal transfer amount exceeds the limit for the specific payment.

Wise vs CurrencyFair: business

Wise offers a broad suite of business services while CurrencyFair has a focus on international business payments.

| Wise Business | CurrencyFair Business |

|---|---|

|

|

Wise vs CurrencyFair: customer service

The easiest way to get support for Wise is to log into your account online or in the provider app and start a chat with a member of the team. CurrencyFair also offers phone and email support, or you can get the correct phone number based on your specific query, on their website.

Conclusion

Both CurrencyFair and Wise offer good international payment options for individuals and business customers. CurrencyFair covers 20+ currencies, and can support payments to 150 countries, while Wise has 40+ currencies on offer, and allows transfers to 160+ countries. Wise also has multi-currency accounts which you can use to receive, hold and exchange foreign currencies, and which offer a debit card for spending and cash withdrawals. This service isn’t on offer from CurrencyFair.

If you need account and card services, try Wise. And if you want to make a transfer and both providers cover your destination country and currency it may be best to compare the overall costs of each to get the best available deal.

Frequently asked questions - Wise vs CurrencyFair

In our comparisons, Wise was slightly cheaper than CurrencyFair for transfers to USD and EUR.

CurrencyFair payments are likely to take a day or two - the exact delivery time will depend on where you're sending money to. Wise payments can arrive instantly, with most being delivered within 24 hours.

CurrencyFair offers payments in 20+ currencies to 150 countries. Wise customers can send payments to 80+ countries, and hold and manage 50+ in their Wise accounts.

Wise and CurrencyFair both offer international payments, but they have different focus areas which may mean they appeal to different customer needs. Wise has multi-currency accounts and cards as well as transfers to 160+ countries, while CurrencyFair has a focus on digital transfers to 150+ countries.

It depends on your needs. If you need a multi-currency account to hold a balance and also want to send and receive foreign currency payments, Wise may be your best bet. If you’re just looking for transfers, compare Wise and CurrencyFair to see which is better for your specific needs.